Government programmes which grant women access to financial support often provide assistance which is too small to significantly impact women’s economic position within the household. This article uses data on loans granted to members of NRLP self-help groups and finds that increasing women's access to financial resources enhance their decision-making role within the household. However, only large loans have this effect, while providing women with small loans yields similar results to improving the financial position of the household.

Improving women’s intra-household bargaining power and decision-making ability is an important objective of microfinance and other programmes that support women’s financial inclusion. However, mirroring the mixed success of microfinance programmes in reducing poverty, existing literature suggests considerable variation in their effect on women’s decision-making, with limited evidence of strong effects – for example, Banerjee, Karlan and Zinman’s (2015) review of several microfinance programmes finds insignificant effects on women’s decision-making ability in three out of the four studies that evaluated this outcome. Similarly, Jayachandran et al.’s (2020) review of livelihoods-focused self-help groups (SHGs) reveals positive effects on women’s decision-making ability in only half the studies they examined.

One explanation for the marginal effects of microfinance programmes comes from theoretical models of poverty traps. These models postulate that movements out of poverty require a ‘big push’ that generates a large jump or change in the resource base of poor households. Responding to this, governments are increasingly embracing programmes that grant ultra-poor1 women livelihood-generating assets such as livestock, while also providing them with training to upgrade their skills and other complementary inputs.

But can ‘big push’ programmes enable a change in women’s status? And, if so, are there less costly ways of making this push to ensure a much wider coverage of all below-poverty-line women, and not just the ultra-poor? In a recent study (Kochar et al. 2022), we address these questions, drawing on India’s experience with SHGs under the National Rural Livelihoods Project (NRLP)2.

The National Rural Livelihoods Project’s potential to impact women’s decision-making

The NRLP seeks to enhance women’s livelihoods through support for a federation of community institutions. SHGs comprising 10-15 women from the same residential neighbourhood of the village constitute the lowest tier of this three-tier federation. As in other such programmes, membership in a NRLP SHG requires regular savings; in early stages of a SHG’s life cycle, loans are based on the group’s accumulated internal savings. Given the small amounts saved monthly, SHGs’ savings accumulate very slowly. Amongst SHGs surveyed by us, monthly savings varied from Rs. 10 to Rs. 100, with a mean of Rs. 30 and a median of only Rs. 10. Correspondingly, initial loan amounts are small: The average loan size across all SHG members in the first year of formation for SHGs in our sample3 is just Rs. 1,014, with this number increasing to Rs. 4,150 if the sample is confined to those who borrow. This latter amount is equivalent to wage earnings from approximately 20 days of work. At this level, it is unlikely that the loans offered by the programme would significantly impact women’s economic position within the household.

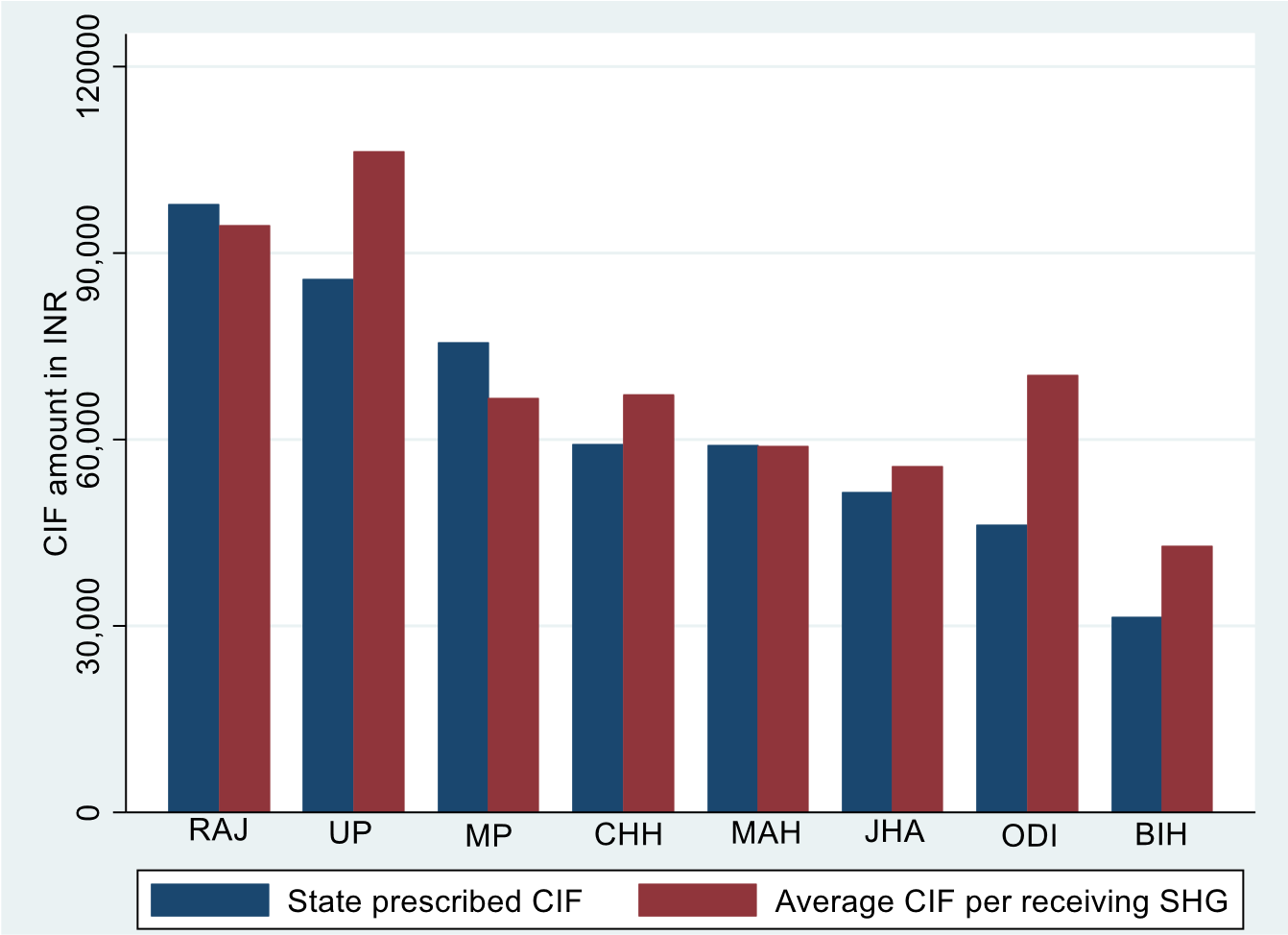

The NRLP, however, promoted an institutional architecture that magnified the economic benefits to members over time. This was primarily through the Community Investment Fund (CIF), a grant-in-perpetuity to SHGs that doubled average loan amounts granted to individual members. Repaid funds remain within the SHG federation to support continued internal lending, and hence provide the basis for a significant improvement in incomes. Though the central government set guidelines for the CIF amount per SHG, each state has the discretion to independently determine funding amounts. The variation in state funding per SHG is significant, ranging from Rs. 30,000 to Rs. 110,000.

Survey data

To evaluate the NRLP we implemented a cross-sectional survey of approximately 15,000 SHG members across eight of India’s poorest states in 2019, as the programme approached its end4. The data thus enabled us to evaluate the impact of the programme at scale, after it had reached almost universal coverage of its targeted 70 million below-poverty-line households5.

The survey was designed to identify the impact of the NRLP by exploiting its phasing both across blocks, and within blocks across villages, of the country, and provides a wealth of information on households and SHGs. The programme’s design called for inputs such as CIFs to be 'layered' on each other so that the set of inputs6 provided to a SHG increased with its ‘age’. The considerable variation in the programme’s start date across villages and hence in SHGs’ age therefore generates corresponding variation in the programme inputs provided to SHGs – variation that is rarely available in studies based on pilots of programmes in a particular state.

The state-level variation in the average amount of CIF per SHG prescribed by the state, as well as survey data on the average amounts reported per receiving SHG are depicted in Figure 1. The figure suggests that the amounts received per SHG closely followed state norms in most instances.

Figure 1. Average CIF amount prescribed by states, and average amounts reported being received by SHGs

The study

We evaluate the impact of CIFs on an index of women’s decision making by using difference-in-difference methodology.7 This approach follows Duflo (2001), Jacoby (2002) and others who use cross-sectional variation in the duration of exposure of households to the programme to identify its effects through difference-in-difference regressions.

We exploit variations in the incidence of treatment at the level of SHGs: we compare outcomes for SHGs that did and did not receive CIFs in high-CIF states, relative to the same difference observed in low-CIF states.

These state-level differences in the CIF amount allow us to control for possible endogenous variation in programme intensity, and incidence caused by factors such as the provision of larger CIF amounts in states with better implementation, or the targeting of ‘superior’ SHGs. Our ability to identify the impact of CIFs is enabled by the large number of states covered in our survey, and the extensive phasing of the programme across blocks and villages. The former ensures significant variation in CIF amounts received per SHG across states; while the latter generates variation in the incidence of CIFs across SHGs. Differences across both dimensions are critical for identification of the impact of CIFs. In addition to tests of identification and the assumptions underlying a difference-in-difference regression, we also subject our results to a broad set of falsification tests,8 including to check whether the results merely reflect differences in socio-economic conditions across states.

We follow the literature in measuring women’s decision-making based on their answers to a series of questions related to their role in household decisions.9 To ensure the credibility of results, we report results using different methods to compile responses into an index of women’s intra-household decision-making power.

Findings

We find strong evidence that these large improvements in a woman’s access to financial resources enhance her decision-making role within the household. The provision of CIF in high-CIF states raises women’s decision-making by 0.10 points, a 2.2% increase over the mean value of 3.08 (out of a maximum score of 5).

We extend our analysis to address the policy relevant question of whether targeting women for financial inclusion generates benefits beyond improving financial access for households, irrespective of who within the household has access to loans. Building on a large body of research that tests the unitary or income-pooling model10 (Thomas 1990, Bourguignon et al. 1993) we confirm that women’s financial access to CIF funds affects household consumption allocations even after taking into account the effect of the totality of the financial resources that the household possesses. This evidence supports the view that women’s access to large loans affects households not just because they increase the household’s resources, but also because they improve women’s bargaining weight or decision-making ability.

However, we find that this result applies only to large loans: women’s access to the significantly smaller loans available after one year of internal SHG savings (without access to CIFs) affect consumption allocations only through their effect on household savings. That is, providing women with access to small loans yields results that are similar to improvements in the overall financial position of the household, implying no benefit from targeting women. This helps explain why several studies that evaluate SHGs even after a period of three years or so find their impact on household consumption to be minimal (Banerjee, Karlan and Zinman 2015).

Policy implications

As previously noted, our research relates to the growing evidence on multifaceted "Graduation" programmes11 that provide large grants, training and other complementary inputs to ultra-poor households (Banerjee et al. 2015). In general, these studies report large and sustained improvements in asset ownership, income and expenditure, as do evaluations of other programmes that provide large cash transfers to households. Whether these large transfers improve women’s decision-making is an open question. The review of six ultra-poor “Graduation” programmes in Banerjee et al. (2015) suggests that there was no impact three years after the program was introduced, though there appeared to be some early gains in a study conducted two years after the initial survey.

Even if the effect of large cash transfer programmes on women’s empowerment were positive, their cost suggests a limited potential to impact outcomes on scale; though BRAC’s programme12 covered 360,000 households by 2014 and was intended to reach 650,000 households by 2016, these numbers are small relative to that of the NRLP in India.

By 2020, the NRLP reached over 72 million households through 7 million SHGs, suggesting the ability to transform women’s status if the features which made the programme successful can be ensured and sustained in all SHGs. This, of course, remains the challenge: ensuring that features of the programme’s design that enable a sizeable impact on women are implemented in full, and not scaled back to a level where their effect is negligible.

Notes:

- In the six programmes evaluated by Banerjee et al. (2015), the 'ultra poor' were identified as the poorest of the poor by village households, using Participatory Wealth Ranking, a targeting method that requires community involvement. Of the identified households, 48% had a daily per capita consumption below purchasing power parity $1.25.

- National Rural Livelihoods Project (NRLP) has been designed as a sub-set of the National Rural Livelihoods Mission to create ‘proof of concept’ in 13 high poverty states to build capacities of the Centre and states, and create an enabling environment to facilitate all states and Union Territories to transition to the NRLM.

- SHGs in our sample were formed between 2012 and 2018.

- The NRLP was initiated in 2011, and ran until 2019. In the final year of the programme, our survey was implemented in Bihar, Chattisgarh, Jharkhand, Madhya Pradesh, Maharashtra, Odisha, Rajasthan and Uttar Pradesh.

- Target households were spread across 600 districts and 600,000 villages.

- For example, CIFs were provided following the provision of revolving funds (RFs), and after the federation of SHGs into village organisations (VO). Other inputs, including additional trainings on SHG and VO management and linkage with banks, followed the introduction of the VO. A final set of inputs such as livelihood trainings were provided to SHGs only after the federation of VOs into cluster-level federations.

- Difference-in-difference is a technique to compare the evolution of outcomes over time in similar groups that gained access to an ‘intervention’ with other groups that did not.

- Falsification tests ensure that the results are unique to the intervention in question and hence support the credibility of the methodology and estimates. For example, we showed that while the methodology explains the variation in the availability of CIF funding, it does not explain variation in the incidence of the RFs provided to each SHG. This supports our contention that the methodology identifies the impact of CIFs, and not of other inputs provided to SHGs.

- See Banerjee, Karlan and Zinman (2015); Tarozzi, Desai and Johnson (2015); Banerjee, Duflo, Glennerster and Kinnan (2015); Angelucci, Karlan and Zinman (2015).

- The income pooling model assumes that all members of the household pool their incomes together. Consequently, household consumption decisions are based on the totality of household income, and do not vary with whether the income is earned by males or females.

- “Graduation” programmes, such as NRLP and those described in Banerjee et al. (2015), are those in which a number of inputs or interventions are layered on each other.

- The Bangladesh Rural Advancement Committee (BRAC) is an international development organisation based in Bangladesh that pioneered the Graduation approach to support people to lift themselves out of extreme poverty.

Further Reading

- Angelucci, Manuela, Dean Karlan and Jonathan Zinman (2015), “Microcredit Impacts: Evidence from a Randomized Microcredit Program Placement Experiment by Compartamos Banco”, American Economic Journal: Applied Economics, 7(1): 151-82.

- Banerjee, Abhijit, Dean Karlan and Jonathan Zinman (2015), “Six Randomized Evaluations of Microcredit: Introduction and Further Steps”, American Economic Journal: Applied Economics, 7(1): 1-21.

- Banerjee, Abhijit, et al. (2015), “A multifaceted program causes lasting progress for the very poor: Evidence from six countries”, Science, 348(6236).

- Banerjee, Abhijit, Esther Duflo, Rachel Glennerster and Cynthia Kinnan (2015), “The Miracle of Microfinance? Evidence from a Randomized Evaluation”, American Economic Journal: Applied Economics, 7(1): 22-53.

- Bourguignon, Francois, Martin Browning, Pierre-Andre Chiappori and Valerie Lechene (1993), “Intra-Household Allocation of Consumption: A Model with some Evidence from French Data”, Annales d’Economie et de Statistique, 29: 138-156.

- Chiappori, Pierre Andre and Maurizio Mazzocco (2017), “Static and Intertemporal Household Decisions,” Journal of Economic Literature, 55(3): 985-1045.

- Duflo, Esther (2001), “Schooling and Labor Market Consequences of School Construction in Indonesia: Evidence from an Unusual Policy Experiment”, American Economic Review, 91(4): 795-813.

- Jacoby, Hanan G (2002), “Is There an Intrahousehold ‘Flypaper Effect’? Evidence from a School Feeding Programme,” The Economic Journal, 112(476): 196-221.

- Jayachandran, Seema, Eleonora Guarnieri, Lucia Diaz-Martin and Akshara Gopalan (2022), “Greater than the Sum of the Parts? Evidence on Mechanisms Operating in Women’s Groups,” Forthcoming in World Bank Research Observer, 38(1). Available here.

- Kochar, Anjini, Closepet Nagabhushana, Ritwik Sarkar, Rohan Shah and Geeta Singh (2022), “Financial Access and Women’s Role in Household Decisions: Empirical Evidence from India’s National Rural Livelihoods Mission”, Journal of Development Economics, 155. Available here.

- Tarozzi, Alessandro, Jaikishan Desai and Kristin Johnson (2015), “The Impacts of Microcredit: Evidence from Ethiopia,” American Economic Journal: Applied Economics, 7(1): 54-89.

- Thomas, Duncan (1990), “Intra-Household Resource Allocation: An Inferential Approach,”, The Journal of Human Resources, XXV(4): 635-664.

Social media is bold.

Social media is young.

Social media raises questions.

Social media is not satisfied with an answer.

Social media looks at the big picture.

Social media is interested in every detail.

social media is curious.

Social media is free.

Social media is irreplaceable.

But never irrelevant.

Social media is you.

(With input from news agency language)

If you like this story, share it with a friend!

We are a non-profit organization. Help us financially to keep our journalism free from government and corporate pressure

0 Comments