Inflation targeting in India is a work-in-progress, with a five-year review due by March 2021. This article presents an interim assessment suggesting that significant progress has already been achieved to date: this is evident in the reduced volatility of a range of inflation-related outcomes and in the stronger anchoring of inflation expectations, which appears to have enhanced the ability of the RBI to respond to the exceptional Covid-19 shock.

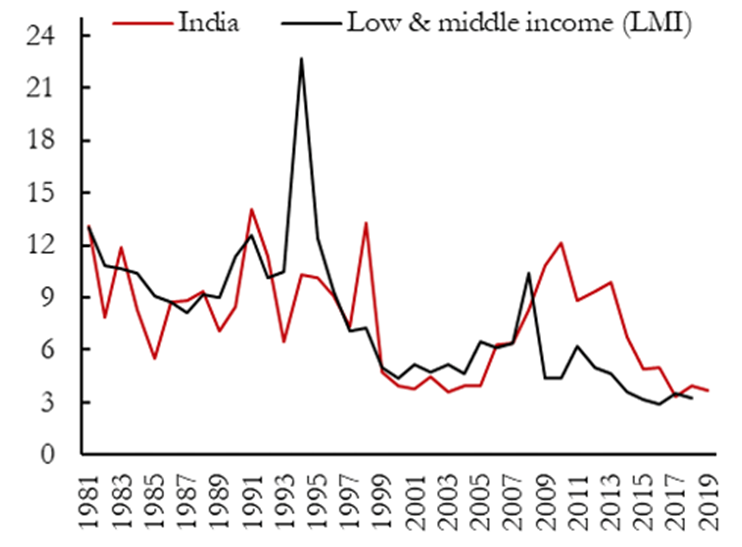

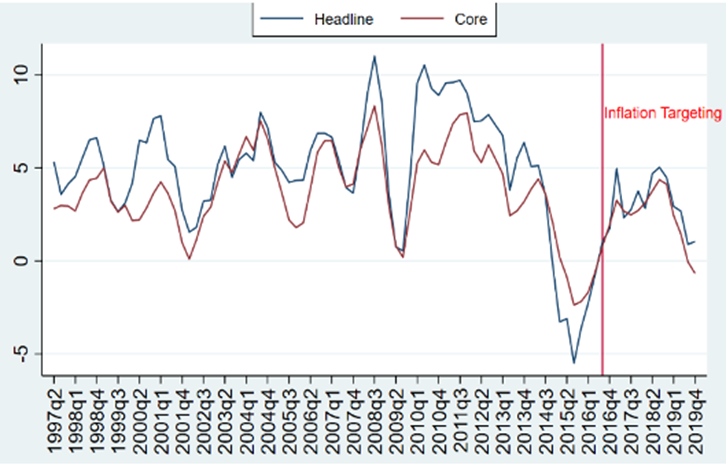

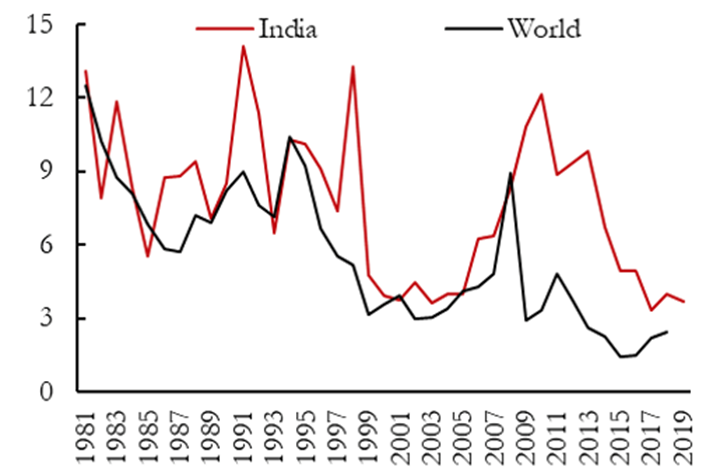

Policy toward inflation in India has a somewhat chequered history (for example, Mohan and Ray 2018, Das 2020, Hutchison et al. 2013). Inflation in India has averaged 8% or more since the 1980s, except in the early 2000s when it averaged 4% and more recently when inflation fell with the move to inflation targeting (IT). Levels have exceeded average global inflation for the most part (Figure 1), while fluctuations have broadly tracked those in other low- and middle-income countries, aside from 2009-2015. Basu et al. (2015) attribute India’s relatively high inflation in this period to large budget deficits and easy monetary policy in years that coincided with national elections.

Figure 1a. Long-term inflation rate (consumer prices) in India and its co-movement with global inflation

Figure 1b. Long-term inflation rate (consumer prices) in India and its co-movement with low- and middle-income countries

Source: WDI; authors’ calculations

Inflation targeting in India

The RBI (Reserve Bank of India) has followed a variety of policy strategies over the years. Following a long period of ‘fiscal dominance’ during which the RBI was expected to monetise budget deficits, the fiscal framework was reformed and strengthened in the early years of the current century, allowing the RBI to exert more independence and bring inflation down to levels characteristic of other low- and middle-income countries. This transition culminated in the inflation-targeting agreement of February 2015 and an amended RBI Act in May 2016,1 which gave the Central Bank a statutory inflation target. At this point the RBI adopted a full IT framework, emulating international best practice.

These changes are recent; the amended RBI Act celebrated its fourth anniversary last year. Consequently, its consequences have been the subject of little systematic analysis. Moreover, its efficacy is now being subjected to ‘the mother of all stress tests’ in the form of the Covid-19 pandemic.

Four years of experience is just enough on which to base a preliminary analysis, and the challenge of the pandemic makes it even more important to extract lessons from that experience. This is what we seek to do in recent research (Eichengreen et al. 2020).

Key findings

Some of our findings may be surprising. Contrary to conventional wisdom that the RBI should focus on core inflation2 and ‘look through’ volatile and transient food-price inflation, we find that food-price inflation can de-anchor expectations3 and spill over into core inflation; by implication, monetary policy should respond. Food prices account for a much larger share of consumption baskets in India than in many other countries. It follows that they cannot be benignly neglected by the RBI as they are by many, if not most, advanced-country central banks.

We show that the RBI is best characterised as a flexible inflation-targeter: contrary to perceptions, it does not neglect changes in the output gap4 when setting policy. We do not find that the RBI became more hawkish following the transition to IT; to the contrary, adjusting for inflation and the output gap, policy rates became lower, not higher.

Better anchoring

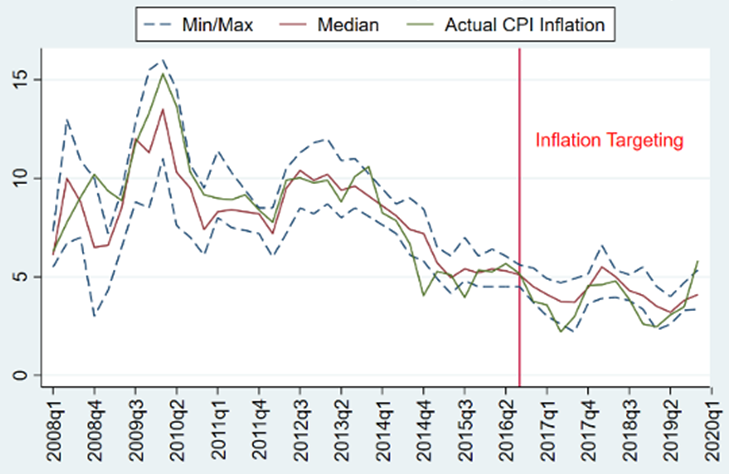

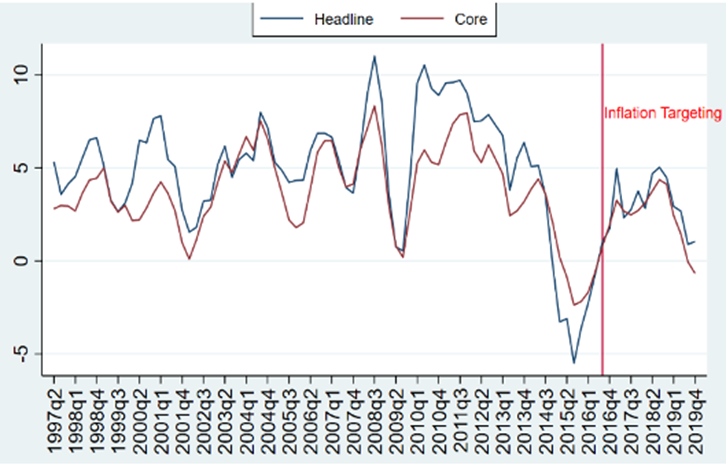

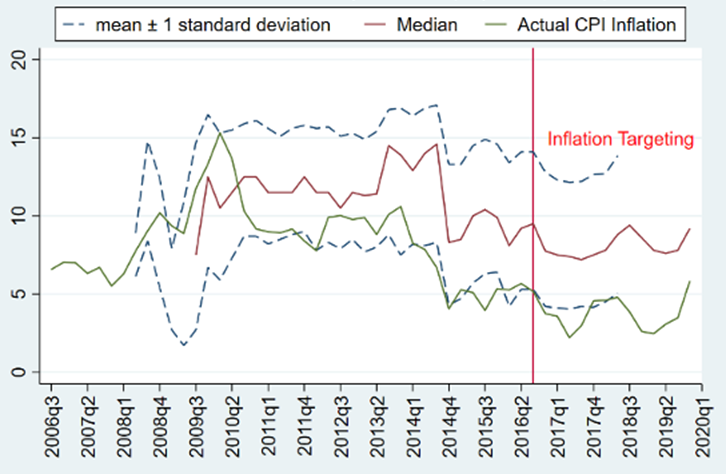

Importantly, we find evidence that inflation has become better anchored. Both the inflation forecasts of financial professionals (Figure 2, bottom panel) and the responses to inflation forecasts of households (Figure 2, top panel) declined with the shift to IT, although household expectations of inflation continue to consistently exceed actual outcomes.

Figure 2. Expectations before and after inflation targeting

Note: Household inflation expectations, one quarter ahead

Source: CEIC database; authors’ calculations

Note: Professional forecasters’ inflation expectations, one quarter ahead.

Moreover, increases in actual inflation now do less to excite inflation expectations, indicative of improved anti-inflation credibility. This is true for the expectations of both households and professional forecasters, although the change is largest and most significant for the financial professionals.

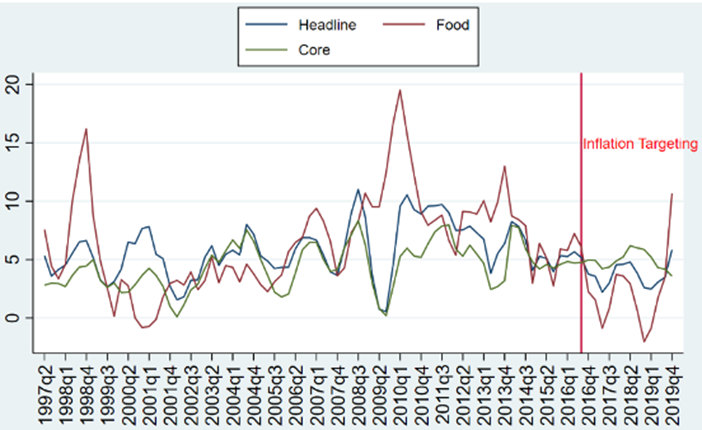

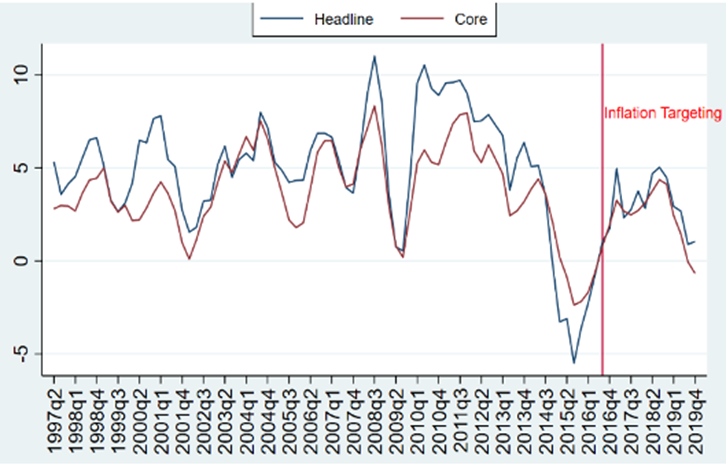

Further consistent with this conclusion of better anchoring, a number of inflation-related outcomes – the level and volatility of inflation, the stability of inflation expectations, the behaviour of ancillary variables such as the exchange rate and equity markets – are more stable than before (Figure 3).

Figure 3. Inflation and its volatility

a) Consumer price inflation

b) Wholesale price inflation

c) Consumer price inflation volatility

d) Wholesale price inflation volatility

Source: CEIC database; authors’ calculations

Note: Inflation volatility is computed as 15-month rolling standard deviation of monthly inflation series which is then averaged at quarterly frequency.

Covid-19 and credibility

Finally, we ask whether the RBI, having gained credibility with the shift to IT, is in a position to take extraordinary steps in response to Covid-19. We argue that this is the case, and that rules like those governing modern IT regimes come with implicit escape clauses allowing central banks credibly committed to those regimes to deviate, under exceptional circumstances, without untoward consequences. Specifically, we show that the better anchoring of inflation expectations has enhanced the scope for the RBI to respond to an exceptional shock like the Covid-19 pandemic – a shock that is (i) independently verifiable and (ii) not of the authorities’ own making – despite the fact that inflation was already running at the top of the target range and that Covid-19, as a negative supply shock, might be expected to raise inflation. Our study also shows that central banks following IT were able to respond more forcefully to the Covid-19 crisis, consistent with the idea that inflation expectations were better anchored, giving them more policy room for manoeuvre.

Conclusion

Inflation targeting in India is barely four years old, a fact that has hindered earlier efforts at performance evaluation. Here we take advantage of the (limited) accumulation of data to analyse what, if anything, changed with the advent of IT. We show that the RBI is best characterised as a flexible inflation-targeter – contrary to some assertions and criticisms, it does not neglect changes in the output gap when setting policy rates. We do not find that the RBI became more hawkish following the transition to IT; to the contrary, adjusting for inflation and the output gap, policy rates became lower, not higher. We find some evidence that inflation has become better anchored: increases in actual inflation do less to excite inflation expectations, indicative of improved anti-inflation credibility. This is consistent with the fact that a number of other inflation-related outcomes are more stable post-IT than before.

Finally, we ask whether the shift to IT has enhanced the credibility of monetary policy such that the RBI is in a position to take extraordinary action in response to the Covid-19 crisis. We argue that the rules and understandings governing IT regimes come with escape clauses allowing central banks to disregard their inflation targets, under specific circumstances satisfied by the Covid-19 pandemic. Cross-country comparisons confirm that inflation targeting, in conjunction with related institutional arrangements, has had benefits in terms of additional policy room for manoeuvre in the crisis.

A version of this article originally appeared on VoxEU.

I4I is now on Telegram. Please click here (@Ideas4India) to subscribe to our channel for quick updates on our content

Notes:

- The 2016 amendment to the RBI Act provides for a statutory and institutionalised framework for a Monetary Policy Committee (MPC). The MPC would be entrusted with the task of fixing the benchmark policy rate (repo rate) required to contain inflation within the specified target level. This inflation target has been set at 4% with a 2% and 6% lower and upper tolerance level respectively.

- Core inflation is general inflation except that it does not incorporate price changes in the food and energy sectors. This measure of inflation excludes these items because their prices can be very volatile.

- Long-term inflation expectations are said to be anchored if they are in line with the inflation objective of the central bank and do not respond to macroeconomic surprises or developments in short-term inflation expectations.

- The output gap is an economic measure of the difference between the actual output of an economy and its potential output.

Further Reading

- Basu, Kaushik, Barry Eichengreen and Poonam Gupta (2015), "From Tapering to Tightening: The Impact of the Fed’s Exit on India", India Policy Forum, National Council of Applied Economic Research, 11(1): 1-66.

- Basu, K, B Eichengreen and P Gupta (2014), ‘From tapering to tightening: The impact of the Fed's exit on India’, Ideas for India, 27 November.

- Das, S (2020), ‘Seven Ages of India’s Monetary Policy’, Reserve Bank of India Governor’s Speech.

- Eichengreen, B, P Gupta and R Choudhary (2020), ‘Inflation Targeting in India: An Interim Assessment’, World Bank Policy Research Working Paper WPS9422.

- Hutchison, Michael H, Rajeswari Sengupta and Nirvikar Singh (2013), "Dove or Hawk? Characterizing Monetary Policy Regime Switches in India”, Emerging Markets Review 16(C): 183-202.

source ; ideasforindia

Social media is bold.

Social media is young.

Social media raises questions.

Social media is not satisfied with an answer.

Social media looks at the big picture.

Social media is interested in every detail.

social media is curious.

Social media is free.

Social media is irreplaceable.

But never irrelevant.

Social media is you.

(With input from news agency language)

If you like this story, share it with a friend!

We are a non-profit organization. Help us financially to keep our journalism free from government and corporate pressure

0 Comments