Looking at variations in factor misallocation across states, Chaurey et al. measure trends in factor adjustment costs incurred by firms between 1999 and 2014. They find that adjustment costs for labour and land across India fell during this period, with the decline in labour adjustment costs declining significantly faster in states with fast growing manufacturing. They discuss other factors which affect adjustment costs, including firm size and governance quality of state, and the pattern between misallocation and low growth.

There is growing evidence that factor misallocation has constrained firm performance in India and could be one of the reasons for the absence of economic convergence between states. The evidence suggests that aggregate output could be increased by reallocating existing resources towards firms that can use them more productively, thereby reducing misallocation – by one estimate, simply reallocating resources between Indian firms in a way that matches US’ levels of efficiency in resource allocation could increase India’s aggregate productivity by 60-80% (Hsieh and Klenow 2009).

Misallocation is possible across all factors of production – labour, land, and capital. A large literature suggests that rigid industrial labour regulations reduce employment and productivity in firms (Besley and Burgess 2004). Some recent studies suggest that rigid land use regulations, such as land ceiling laws, have reduced productivity (Duranton et al. 2015). Research on a related topic – the impact of policies promoting industrial parks and Special Economic Zones – is also growing. Since state governments in India have jurisdiction over many policy areas affecting factor markets, the design and implementation of factor market policies vary across states. It is possible that some states remain poorer than others not because of a deficiency of resources, but because of an inefficient allocation of existing resources. Despite the strong influence of state governments on factor market policies, there has been surprisingly little systematic analysis of how factor market misallocation and related policies vary across Indian states.

Study design

In a recent study (Chaurey et al. 2022), we contribute to this policy-relevant research agenda by using Indian firm-level panel data from 1999 to 2014 to describe trends in factor market distortions across Indian states. We look at ‘permanent’ labour, ‘temporary’ (or contract) labour, land, and fixed capital, and establish stylised facts about how factor market distortions have evolved across Indian states. Furthermore, we complement the results of the data analysis with information gathered through firms’ interviews in Telangana and Uttar Pradesh and suggest areas of focus for future policy analysis.

We adopt a cost-minimisation approach to measure trends in factor ‘adjustment costs’ over time. The ‘adjustment cost’ of a factor can be considered as an implicit variable cost incurred by a firm in using that factor.1 This characterisation is like the ‘implicit taxes’ on inputs modelled in Hsieh and Klenow (2009), a seminal study of factor misallocation in India. The potential causes of this implicit cost include market frictions, institutional factors and factor market regulations which make it harder for firms to employ or adjust their inputs.

Findings

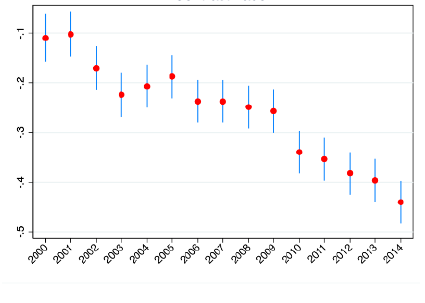

We find that at the all-India level, the adjustment costs for permanent labour, contract labour, and land all fell between 1999 and 2014. There was a small increase in the adjustment cost for permanent labour between 2004-2007, but the trend has been decreasing since 2009. The decline is most dramatic in the case of contract labour (Figure 1). In contrast to labour and land, the adjustment cost for fixed capital (excluding land) did not decline over the years.

Figure 1. Trend in adjustment cost for contract labour

Notes: i) The y-axis depicts the estimated adjustment cost of contract labour relative to that in 1999 (the baseline year). ii) The blue bars depict the 95% confidence intervals2.

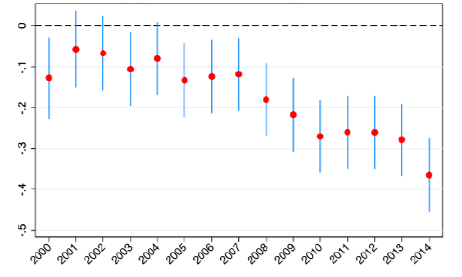

Next, we examine how these trends vary across states, and by firm attributes such as size. We split states into two groups based on their manufacturing growth rates over the study period and find that the decline in permanent and contract labour adjustment costs has been significantly faster in states with fast-growing manufacturing compared to states with slow-growing manufacturing (Figure 2). The decline in land and capital adjustment costs, in contrast, is not correlated with state-level growth performance. As regards firm attributes, we show that firm size plays a role, particularly for land. The decline in permanent labour adjustment costs has been experienced by firms of all sizes, but at a significantly faster pace among ‘large’ firms (those with more than 50 workers) compared to `small’ firms (those with 10 to 50 workers). Contract labour adjustment costs, in contrast, have fallen faster among smaller firms. Strikingly, land-related adjustment costs have trended in opposite directions, declining for large firms but increasing for small firms.

Figure 2. Adjustment cost for contract labour in high growth states relative to low growth states

Notes: i) The y-axis depicts the estimated difference in the adjustment cost of contract labour between high and low growth states, relative to that in 1999 (the baseline year). ii) The blue bars depict the 95% confidence intervals..

To corroborate our empirical analysis, we also conduct field interviews with small and medium enterprises in Telangana and Uttar Pradesh. We document the important role of governance in shaping the effective enforcement of factor market policy, and show that broad state-level governance measures are strongly correlated with firms’ perceptions about business environment, regulatory ease, and transparency.

Using an index of governance quality, we split states into ‘high’ and ‘low’ governance groups. We puzzlingly find that adjustment costs for certain productive factors fell significantly more in the low governance group, compared to the high governance one. A preliminary examination of available indices of governance quality over time suggests a slow convergence in governance quality across Indian states – this could explain our observation, that the states that did not have robust governance structures earlier seem to have also been the most effective in improving their governance over time, which could in turn have produced a greater reduction in firms’ adjustment costs.

Conclusion

In sum, our paper demonstrates an overall decline in factor misallocation for land and labour across Indian firms over the years, with important heterogeneity across states and firms. In particular, our analysis delivers three policy-relevant conclusions: (i) the speed of adjustment cost reduction and the growth of the manufacturing sector are correlated; (ii) firm size matters; and (iii) governance plays an important role. The fact that states diverge both in terms of manufacturing growth and factor market efficiency hints at the existence of a self-reinforcing pattern between misallocation and low growth. As for firm size, our results in particular suggest that there has been increasing land misallocation towards larger firms, with smaller establishments encountering higher barriers in the process of acquiring land or adjusting land use.

Finally, our findings highlight the prominent role of institutional quality, as upgrading governance seems to have paid off in terms of better factor market efficiency. Overall, our analysis suggests various avenues on how regulation, law enforcement, and overall governance style could have affected the path of distortions in the allocation of resources across firms and states in India. Further disentangling these dynamics will represent a crucial step in unleashing productivity growth and reducing the widening economic gaps among Indian states.

Notes:

- Adapting the model from De Loecker and Warzynski (2012), we can derive the change in the factor adjustment cost from data through the change in the ratio of input expenditures. Since we are mainly interested in how the adjustment cost varies over time by state, we regress the ratio of firm-level input shares on firm fixed effects and year dummies interacted with state dummies. The firm fixed effect absorbs the time-invariant output elasticity ratio (ratio of output elasticity with respect to one input, and output elasticity with respect to another input) and other time invariant components of the adjustment cost. Thus, the regression identifies how the adjustment cost has changed relative to the baseline year, and how that change varies by state.

- A 95% confidence interval indicates that if you were to repeat the experiment over and over with new samples, 95% of the time the calculated confidence interval would contain the true effect.

Further Reading:

- Besley, Tim and Robin Burgess (2004), “Can regulation hinder economic performance? Evidence from India”, The Quarterly Journal of Economics, 119(1): 91-134.

- Chaurey, R, R Manghnani, VM Perego and S Sharma (2022), ‘Firm-Level Input Distortion in Indian States’, Work Bank Policy Research Working Paper 10048.

- De Loecker, Jan and Frederic Warzynski (2012), “Markups and Firm-Level Export Status”, American Economic Review, 102(6): 2437-71.

- Duranton, G, E Ghani, A Grover Goswami and W Kerr (2015), ‘The misallocation of land and other factors of production in India’, World Bank Policy Research Working Paper 7221.

- Hsieh, Chang-Tai, and Peter J Klenow (2009), “Misallocation and Manufacturing TFP in China and India”, The Quarterly Journal of Economics, 124(4): 1403-1448.

Social media is young.

Social media raises questions.

Social media is not satisfied with an answer.

Social media looks at the big picture.

Social media is interested in every detail.

social media is curious.

Social media is free.

Social media is irreplaceable.

But never irrelevant.

Social media is you.

(With input from news agency language)

If you like this story, share it with a friend!

We are a non-profit organization. Help us financially to keep our journalism free from government and corporate pressure .

0 Comments