To understand the economic impact of natural disasters, this article uses the 2018 floods in Kerala – a time when it received higher rainfall than the neighbouring states of Karnataka and Tamil Nadu – to design a natural experiment. Using household and district-level data, the study finds that although flooding lowered economic activity during the disaster, the demand for credit, household income and wages all increased relative to the neighbouring states during the post-disaster boom, facilitated by labour market conditions and government’s reconstruction efforts.

Natural disasters can cause large economic damage both by directly impacting the population and their resources, as well as by indirectly affecting production capacity and economic decisions. Economic losses due to natural disasters are estimated to have been close to US$ 3 trillion between 1998 and 2017 (United Nations Office for Disaster Risk Reduction, 2018). Over three-quarters of the damage has been caused by climate-related disasters, with the United States suffering the most, followed by China, Japan, and India. In India, more than 300 floods have been recorded since 1950, killing at least 75,000 people and rendering more than 900 million people injured, homeless, or otherwise affected.

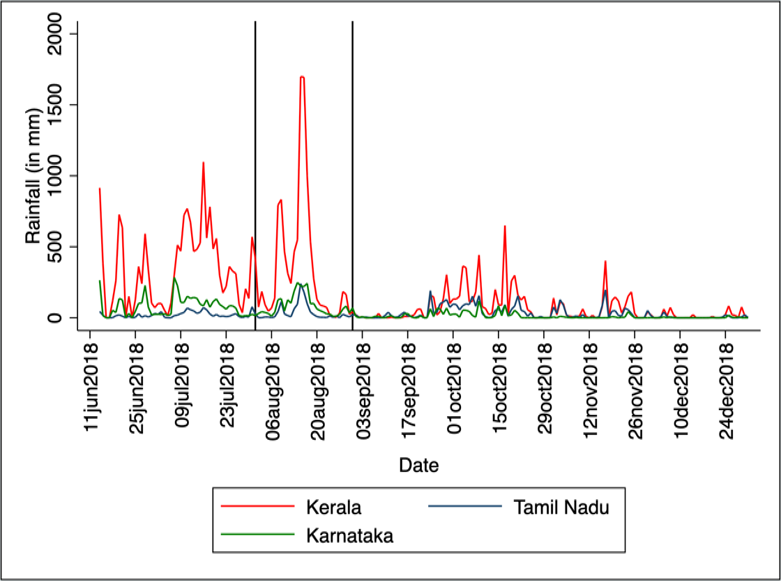

In Beyer et al. (2022), we study the short-run impact of a major flood in India on the economy and economic agents using several monthly and quarterly outcome variables. We look at the case of Kerala, a state in Southern India which experienced severe rainfall, landslides, and floods between June and August 2018. Every year in June, the southwest monsoon enters India, and Kerala is usually the first state that receives rainfall. From 1 June to 19 August, 2018, Kerala received 2,335 millimeters (mm) of rain, which was about 46% above normal (see Figure 1). Higher than normal rainfall in June and July led to the first onset of floods towards the end of July. Rainfall further intensified in August, with Kerala receiving total rainfall of 755 mm between 1 and 19 August, about 163% more than normal. Nearly half of the rainfall occurred in just three days – 15 to 17 August – which was about 700% above normal. These were the worst floods in the state since 1924, and the third worst in India since 1900. A total of 504 people died, and 23 million people were directly affected between 7 and 20 August alone. Since similar above normal rainfall and flooding did not occur in the neighbouring states of Karnataka and Tamil Nadu (see Figure 1), we use a difference-in-differences strategy1 to causally estimate the impacts of the Kerala floods on economic activity and household income and expenditure.

Figure 1. Rainfall in the bordering districts of Kerala, Tamil Nadu and Karnataka

Note: The vertical lines are used to mark the beginning and end of August, the month during which Kerala received the heaviest rainfall.

Data and methodology

Floods are frequent in some parts of India. Some of the most affected regions include Central India, stretching from Gujarat and Maharashtra in the west to Odisha on the east coast, and eastern states such as Bihar, West Bengal, and Assam. In regions with frequent floods, households and firms take them into account in their decisions – consequently, they cannot be used to clearly identify the impact of a flood. In line with this, Kocornick-Mina et al. (2020) find that permanent relocation of economic activity in response to large floods occurred only in recently populated urban areas, likely due to substantial learning effects from previous natural disasters. The incidence of extreme rainfall is much lower in southern states such as Karnataka, Kerala, and Tamil Nadu (Roxy et al. 2017). There is no recent precedent for rainfall as in 2018 in Kerala, and the only other recorded floods of comparable magnitudes are those during the monsoons in 1924 and 1961 (Central Water Commission, 2018). This makes the 2018 Kerala floods truly exogenous and supports our identification strategy.

Our analysis employs the following district-level and household-level variables from various sources: (i) Nighttime lights from the Earth Observation Group at the Colorado School of Mines, (ii) ATM transactions from National Payments Corporation of India, (iii) credit and deposit data of scheduled commercial banks from the RBI, (iv) household data from Consumer Pyramids (CMIE), (v) MNREGA data from the Ministry of Rural Development, and (vi) relief information from Kerala government.

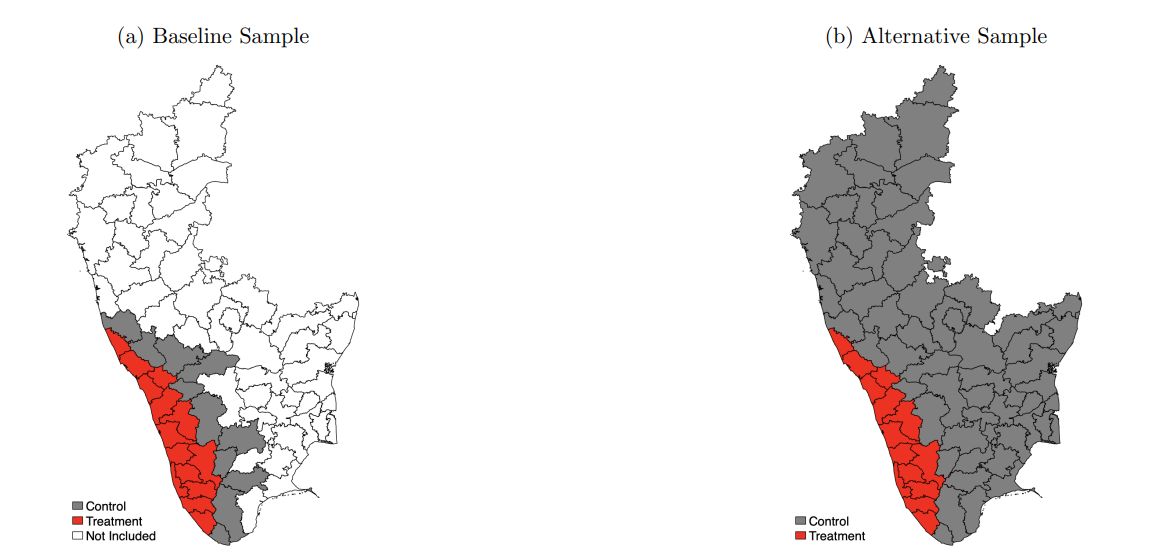

Figure 2 shows the different samples we use for our analyses. For ATM transactions as well as household income and expenditure, we use all the observations in Kerala as our treatment group and all the observations from districts of Karnataka and Tamil Nadu that share a border with Kerala as our control group (Figure 2, panel a). These border districts are likely to have similar agro-climatic conditions than the rest of the neighbouring states. The nighttime light data as well as the credit and deposit data are only available at the district level, so for those we include all the districts of Karnataka and Tamil Nadu as our control group (Figure 2, panel b).

Figure 2. Sample selection

Our findings

We find that flooding lowered economic activity by 7.7% during the disaster (July and August), while during the post-disaster boom, economic activity was 14.8% higher than normal. ATM transactions in Kerala fell in June and July by 2.8 and 3.8%, respectively. In both months, the differences are statistically significant. ATM transactions also fell sharply in September, when they were 10% lower than in unaffected areas. They stayed at that level until October before starting to recover. By December, they reached the same level as before the floods, with no difference compared with those in unaffected areas.

Natural calamities like heavy rainfall and floods may also affect credit demand. If disruptions due to such events result in revenue losses for firms, they may need more working capital. During or after a severe natural disaster, firms may also require fixed capital for replacing machinery and repairing plants. We find that credit disbursal by scheduled commercial banks was significantly higher in Kerala relative to Karnataka and Tamil Nadu in the last quarter of 2018.

Our household analysis suggests that total expenditure of households in Kerala started to decline sharply from July 2018, with the largest decline seen two months later, in September. The monthly coefficients for expenditure remain negative through December 2018, although they decline in magnitude from October 2018 onward. We find that the decline in household expenditure was driven by a large drop in non-essential expenditure, whereas expenditure on food had recovered by October 2018. This is expected, as households are more likely to reduce their expenditure on non-essential items than on food in times of financial stress.

Household total income started to decline from June 2018 and declined further in July, when the difference becomes statistically highly significant. It remained lower in August 2018, but then the coefficients turn positive and statistically significant after September and keep increasing until December, when the income of households in Kerala was 22% higher than that of households in the control group. When we split household income into wage and non-wage incomes, we find that the increase in household income from September onwards is due to a rapid increase in wage income, as non-wage income continues to decline throughout the year.

Effects of post-disaster reconstruction

In line with the results on aggregate economic activity, we hypothesise that a reconstruction boom increased wages. Unfortunately, to the best of our knowledge, no data are available to test this hypothesis directly. Thus, we need to rely on indirect evidence. We use information on the number of households that were provided employment under the MNREGA scheme, and the number of households that demanded employment by registering for the scheme. There is usually a positive difference between those registered and those actually working. If this difference widens, it suggests that there is an increase in excess supply of labour. We instead find that this difference decreased in Kerala relative to the neighboring states after the floods. This indicates a tightening of labour market conditions after the floods, which may have contributed to the fast wage growth.

Although, we find that the income of poorer households declined more during the floods, they benefited much more from the subsequent boom than richer households. This is very much in line with a construction boom, and replicates the experience after Cyclone Aila in Bangladesh, the 2004 Indian Ocean Tsunami, and Yogyakarta earthquake in Indonesia (see Akter and Mallick 2013, Heger and Neumayer 2019 and Kirchberger 2017 respectively).

The Kerala government provided assistance towards immediate relief and rebuilding damaged houses. It is likely that the reconstruction efforts were strongest in districts that received the most relief. This government assistance to different districts of the state immediately after the floods seems to have contributed significantly toward household income recovery in all the months from September to December 2018.

The increase in wages after the disaster without an equivalent increase in expenditure suggests that households in Kerala increased savings. Examining household balance sheet items, such as borrowing and saving, contributes to a better understanding of how households responded to the disaster. However, a mixed picture emerges for outstanding savings of households depending on the instruments used. We find that households in Kerala were more likely to have invested in post office savings schemes. At the same time, however, we find that they were less likely to have investments in bank deposits and gold. It is likely that some households had to dissolve existing savings to repair the damaged property. On the borrowing side, we find that households in Kerala were more likely to have outstanding borrowing for housing (which includes both construction of new residential property and renovation) and medical purposes. This increase in likelihood of borrowings for housing and rundown of the deposits reflect households’ need to repair damage to residential properties following the disaster, as well as inadequate or delayed receipt of relief funding.

Conclusion

To conclude, we provide evidence of a short-run impact on economic activity and household finances of a major natural disaster in India. Our findings indicate a fall in economic activity and household income and spending following the onset of the event in June 2018, with economic activity at the district level recovering by the end of the year. In contrast to the continued decline in spending, household income increased sharply after the floods, which may be attributed to a tight labour market that increased wages and an increase in government reconstruction efforts.

Overall, our findings show that significant disruptions in local economic activity take place after floods. This calls for a targeted disaster management strategy, not only in the immediate aftermath of the floods, but for a longer period, with the objective of bringing economic activity back to normal.

Note:

- Differences-in-differences is a technique used to compare the evolution of outcomes over time in similar groups, where one experienced an event – in this case, floods - which the other did not.

Further Reading

- Akter, Sonia and Bishawjit Mallick (2013), “The Poverty-Vulnerability-Resilience Nexus: Evidence from Bangladesh”, Ecological Economics, 96: 114-124.

- Beyer, RCM, A Narayanan and GM Thakur (2022), ‘Natural Disasters and Economic Dynamics: Evidence from the Kerala Floods’,Policy Research Working Paper 10084, World Bank.

- CWC (2018), Study report: Kerala foods of 2018, Report, Central Water Commission, Government of India. Available here.

- Heger, Martin Philipp and Eric Neumayer (2019), “The Impact of the Indian Ocean Tsunami on Aceh’s Long-Term Economic Growth”, Journal of Development Economics, 141: 102365.

- Kirchberger, Martina (2017), “Natural Disasters and Labor Markets”, Journal of Development Economics, 125: 40-58.

- Kocornick-Mina, Adriana, Thomas K. J. McDermott, Guy Michaels and Ferdinand Rauch (2020), “Flooded Cities”, American Economic Journal: Applied Economics, 12: 2.

- Roxy, M. K, Subimal Ghosh, Amey Pathak, R. Athulya, Milind Mujumdar, Raghu Murtugudde, Pascal Terray and M. Rajeevan (2017), “A Threefold Rise in Widespread Extreme Rain Events over Central India”, Nature Communications, 8: 1-11.

- United Nations Office for Disaster Risk Reduction (2018), 'Economic Losses, Poverty & Disasters', The Centre for Research on the Epidemiology of Disasters (CRED) and UNISDR. Available here.

Social media is young.

Social media raises questions.

Social media is not satisfied with an answer.

Social media looks at the big picture.

Social media is interested in every detail.

social media is curious.

Social media is free.

Social media is irreplaceable.

But never irrelevant.

Social media is you.

(With input from news agency language)

If you like this story, share it with a friend!

0 Comments