The share of bank credit extended to MSMEs increased dramatically during the pandemic. In this post, Harsh Vardhan discusses the the government guarantee of bank loans as a possible driver of this growth. He outlines the current policy of providing credit against collateral, and the constraints MSMEs face while borrowing– which leads to decreased investment and firm productivity. He argues that the learnings from the credit guarantee scheme could be used to design a permanent guarantee scheme for MSME credit.

Micro, small, and medium enterprises (MSMEs) are an important part of the Indian economy. Roughly between 6 and 8 million in number, they are estimated to account for around 30% of GDP and employ more than 100 million. Despite this significant role in the economy, they have been chronically credit starved. Issues of flow of credit to MSMEs has been extensively discussed for a long time and it is fair to say that it remains a policy challenge.

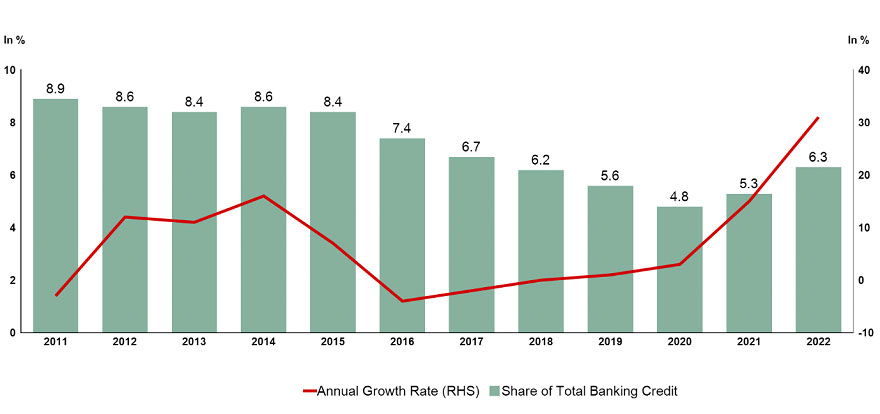

During the Covid-19 pandemic, MSMEs experienced a dramatic growth in credit from the banking sector. Bank credit to MSMEs, which had remained stagnant for almost five years from 2015 onwards, grew by 15% in FY2020-21, and by another 31% in FY2021-22. It is important to keep in mind that the overall bank credit growth in these two years was around 8%. Figure 1 gives details of the annual growth in bank credit to MSMEs, and the share of MSME credit in total bank credit. The share of MSMEs in bank credit, which was stable at around 8.5% for the first half of the last decade, reduced by nearly half to 4.8% by FY 2019-20. To put this in perspective, the share of (unsecured) personal loans given by the banking system in 2020 was 8% of total loans.

Figure 1. Growth and share of credit to MSMEs of total bank credit

Source: Author's calculations based on RBI data

What explains this sudden growth spurt in bank credit to MSMEs? One straightforward explanation is that the pandemic put stress on these enterprises and created a strong demand for credit to tide over the challenge. The supply of credit from the banking systems was driven by the guarantee programme announced by the government as a part of the Covid relief package. The Extended Credit Line Guarantee Scheme (ECLGS) provided government guarantees to bank loans to MSMEs that qualified for this facility based on pre-specified criteria. While these demand and supply based explanations could potentially be the proximate cause of the MSME credit expansion, the sudden expansion of credit also highlights a deeper issue in credit to MSMEs and points to some policy measures that could address this issue.

Prevalence of collateralised credit

Formal financial creditors (banks, chiefly) are information-based lenders. This implies that credit depends on lenders having access to reliable financial information about the borrowers. MSMEs, have historically been starved of credit from the formal banking system, as the information about them was inadequate and/or unreliable. The current policy environment encourages these enterprises to remain small, as many of the benefits (in taxes and duties, labour laws, etc) that they enjoy will get taken away when they grow bigger. Furthermore, a significant part of MSME business is carried out in cash, which makes it harder to create reliable financial information about them. Personal finances of the owner and those of the businesses are often co-mingled, which makes banks wary of lending to them. In order to work around these inherent features of MSMEs, the banking system has used collateralised lending as a method of lending to MSMEs.

Banks lending to businesses almost always involve a ‘primary security’, which is the bank’s claim on the business assets of the borrower in the event of a default. In the case of collateralised lending, the lenders seek additional security, which in India is mostly in the form of a charge on some property (residential, commercial or parcels of land). Essential attributes that the lenders look for in collateral security are ease of ascertaining the value of the security, and liquidity. For these attributes real estate becomes the favourite collateral security.

Prior to 2016, India did not have an effective bankruptcy law, and lenders did not have an efficient mechanism to resolve bankruptcy. This meant that the creditors’ rights were not firmly established in the event of a borrower default. This exacerbated the dependency on collateral security, which could provide lenders with an easy way to recover their dues when borrowers defaulted.

While it is difficult to estimate the exact proportion of collateralised lending in the overall bank credit to MSMEs (as this data is not available in the public domain), anecdotal evidence suggests that an overwhelming share – over 80% – of such lending is with a collateral security. Even for non-banking finance companies (NBFCs) that are seen as more eager to lend to MSMEs, lending is dominated by loans against property (LAP), which is credit given against a collateral security in the form of property.

Implications of collateralised lending

This overwhelming share of collateralised lending creates perverse incentives for the owners of MSMEs. Whenever they generate surpluses in business, there is a strong tendency to invest that in acquiring assets that could serve as collateral for their lending (which, as explained earlier, tends to be real estate). Thus, capital generated by the business is not invested in the business, but used to acquire non-business assets in the form of land, or residential or commercial real estate. As a result, lenders and MSME borrowers are essentially stuck in a low-quality equilibrium, where lenders mitigate credit risk by seeking collateral security and borrowers are incentivised to deploy precious capital in acquiring non-business assets that could serve as collateral. Consumers’ access to credit is thus constrained by the collateral security they can provide to the lenders.

MSME owners also face a peculiar challenge in infusing equity capital into their businesses. These enterprises are often family-owned and constrained by the capital available with family and friends. Many owners have multiple MSMEs, often for the purpose of keeping each entity small to get several benefits. With limited family capital, owners want their equity capital in these enterprises to remain fungible. As a result, they prefer to infuse capital in the form of loans (typically unsecured loans) from the owners, rather than permanent equity capital.

The combined effect of credit access being constrained by availability of collateral, and reluctance to infuse equity capital, results in the MSMEs suffering from chronic undercapitalisation. There is inadequate long-term capital which could enable investments in technology, plants and machinery etc. This underinvestment traps the MSMEs in a cycle of low productivity. Given the large share of employment that MSMEs have, this in turn affects the productivity of the whole economy.

Possible policy interventions

In this context, we can try to understand why the ECLGS was so effective in growing MSME credit. The scheme provided lenders with an alternative to a collateral security. The guarantee under the scheme essentially acting as collateral. This was seen by lenders as an effective risk mitigant and hence, they lent freely, and MSME borrowers, unconstrained by the need to post a collateral security, borrowed heavily.

This gives us an idea for an effective policy intervention that could take the MSMEs out of the low productivity trap described above. If we could create a permanent institutional set up for providing guarantees for MSME credit, then the overwhelming reliance on collateralised lending would reduce. There are obviously some critical issues with such a scheme that must be addressed. Such a permanent scheme would suffer all the problems that government schemes are susceptible to – poor design, misaligned incentives, poor monitoring, with a resulting fiscal drag that has limited impact on output. It could also create problems of moral hazard both for the lender and the borrower.

This is where the experience of the Covid-era experiment with ECLGS could become invaluable. As the results from the scheme are observed over the next few years, they could provide insights into what type of borrowers benefitted most and what actions on part of the lenders worked well, especially in ensuring that defaults stayed low. This experience would enable the thoughtful design of an institutionalised permanent guarantee scheme. Such a design would incentivise MSMEs to make productivity boosting investments, and the lenders can continue to underwrite and monitor credit to MSMEs under such a scheme. The scheme could be made effective to minimise the fiscal burden on the government. A thorough cost-benefit analysis of the scheme could be very insightful in ensuring that benefits from the permanent guarantee scheme outweigh costs.

Other institutional developments, such as the rollout of GST and growth of electronic payments, have already dramatically improved the information available on MSMEs. A carefully designed permanent guarantee ecosystem could further accelerate credit flow.

Conclusion

MSMEs are a critical part of the Indian economy. Given their significant role in the economy, boosting their productivity will boost the productivity of the economy as a whole. The experience of the ECLGS could provide insights that could be used to design a permanent guarantee set up for MSME credit, which in turn could be instrumental in liberating these enterprises from the clutches of collateralised lending and improve their productivity.

Social media is bold.

Social media is young.

Social media raises questions.

Social media is not satisfied with an answer.

Social media looks at the big picture.

Social media is interested in every detail.

social media is curious.

Social media is free.

Social media is irreplaceable.

But never irrelevant.

Social media is you.

(With input from news agency language)

If you like this story, share it with a friend!

We are a non-profit organization. Help us financially to keep our journalism free from government and corporate pressure.

0 Comments