Bureaucracies typically provide low-powered incentives that have less wage differentiation. Theoretically, this incentive structure may be optimal because the multi-dimensional goals of bureaucracy, and the complex tasks that bureaucrats need to complete, make it difficult to measure output and apply performance incentives. In addition, performance-based pay may induce bureaucrats to substitute efforts from other tasks where the output is harder to measure, which may be detrimental to the government's goals of maintaining efficiency in governance (Besley and Ghatak 2018). Thus, private monetary returns to bureaucrats may undermine the optimality of incentive schemes in bureaucracies, especially considering the fact that bureaucrats play a crucial role in state capacity and public service delivery. However, the private returns to bureaucrats are difficult to evaluate because information on the wealth status of bureaucrats is seldom publicly available. In addition, any change in officials' wealth can be due to other factors, such as officers’ unobserved abilities and skills for financial market investment.

In a recent study (Chaudhary and Yuan 2021), we examine this in the Indian context by evaluating the economic returns for bureaucrats after reassignment to important or influential ministries, which provide opportunities to make influential policy decisions.

The Indian Administrative Service: Positions and transfer of officers

The Indian Administrative Service is the highest administrative civil service of the Government of India. Bureaucrats in the IAS have life-long careers, are required to remain politically neutral, are involved in civil administration and policymaking, and occupy the most important posts in the government. In 2019, the IAS had 5,205 officers1. They lead government departments or ministries as secretariats in central and state governments, fill executive administrative roles in districts, oversee state-owned enterprises, and are deployed to international organisations. The pay for IAS officers in a given year is based on the level of seniority and experience in each pay scale of an officer according to The Indian Administrative Service (Pay) Rules.

According to Iyer and Mani (2012), a ministry is identified as ‘important’ by existing IAS officers if they provide opportunities to make influential policy decisions. Ministries and departments considered important are those of Excise and Sales Tax, Finance, Food and Civil Supplies, Health, Home, Industries, Irrigation, Public Works, Urban Development. Other positions of influence include heading the district administration or central government postings. They may also bring about private returns, for example, bribes in exchange for better service delivery or economic benefits.

IAS bureaucrats are transferred frequently during their careers, with most postings having a minimum tenure of two years. In our sample, however, we find that posting changes are quite common during a year which is indicative of the average tenure of IAS officers in our sample at around 16 months. This may be due to the fact that transfers of officers involve several factors such as vacancies, administrative exigency, the matching between posts and bureaucrats, promotion, deputation outside the state, etc. While state-level politicians cannot hire or fire IAS officers, they have the power to evaluate and transfer officers (Banik 2001)2. The transfers of bureaucrats are usually across different districts and departments within the state, and sometimes between the state and central government or public sector companies.

Immovable assets of IAS officers

We digitised over 31,000 Immovable Property Return (IPR) reports of more than 5,100 IAS officers in all states from 2012 to 2020. These reports contain detailed information on all of their immovable property, such as houses or land owned by the officer or any member of their family. The average number of immovable properties is 2.4. The mean and median values of these immovable properties are Rs. 11,519,000 (about US$ 230,380) and Rs. 5,200,000 (about US$ 104,000), respectively. In comparison, India's average wealth per adult was Rs. 544,000 (about US$ 7,140) in 2015. We define our key dependent variables as the logarithm of the value or the number of immovable properties of an officer in a given year. According to the Reserve Bank of India’s (RBI) 2017 Indian Household Finance Report, real estate consists of more than 77% of the total household assets in India (RBI, 2017).

We combine this data with career histories – including postings and the demographic characteristics – of IAS officers during the same period from the Executive Record Sheets of IAS officers. We use a binary variable3 indicating the year during and after which a bureaucrat was reassigned to an important ministry in our panel4 for the first time to capture the lasting impact of reassignment to important ministries.

Effects of bureaucratic reassignment on the assets of bureaucrats

To estimate the effects of bureaucratic transfers on the asset accumulation of bureaucrats, we adopt a staggered difference-in-differences (DID)5 method and an event study approach. We compare the change in immovable properties of officers who experienced and did not experience reassignment to an important ministry, before and after the transfer. In our baseline estimations, we find that transfers to important ministries increase the value of immovable properties by 53% and the number of immovable properties by 19%.

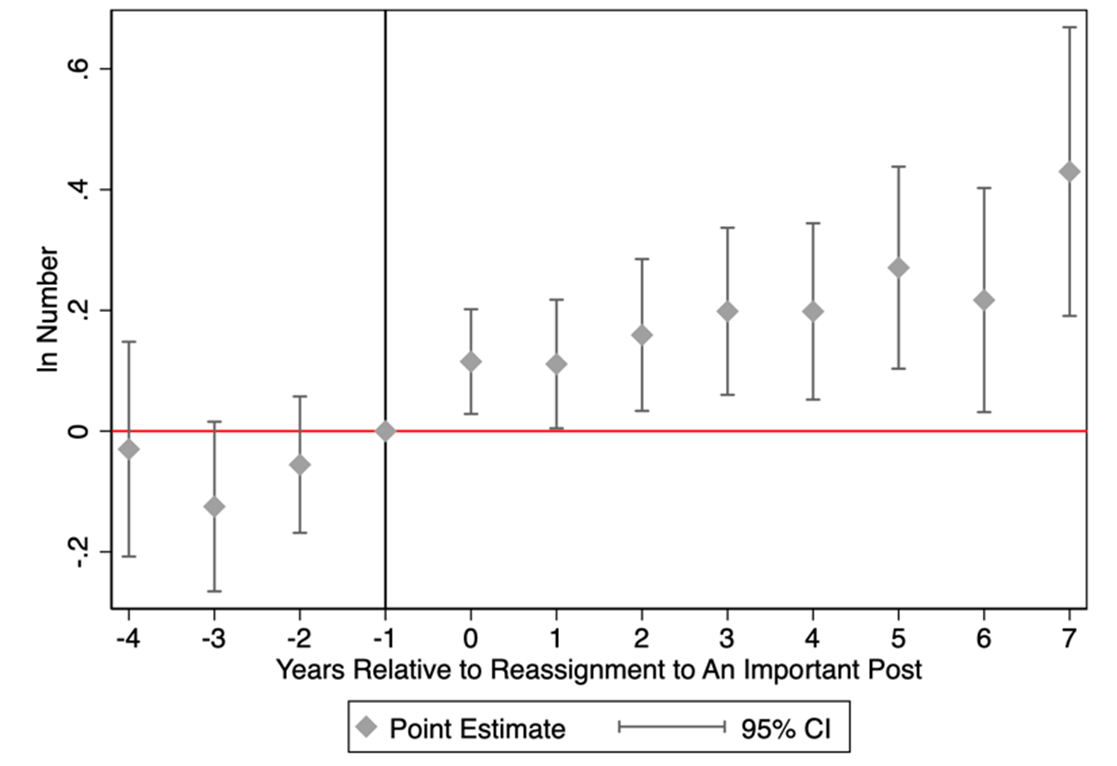

We also evaluate the period-specific effects of reassignment by conducting a more flexible event study estimation6. Figure 1 shows that during the year of transfer, officers, on average, have 12% more immovable properties in terms of number, which increases to 24% after six years.

Figure 1. Reassignment of officers and change in the number of assets

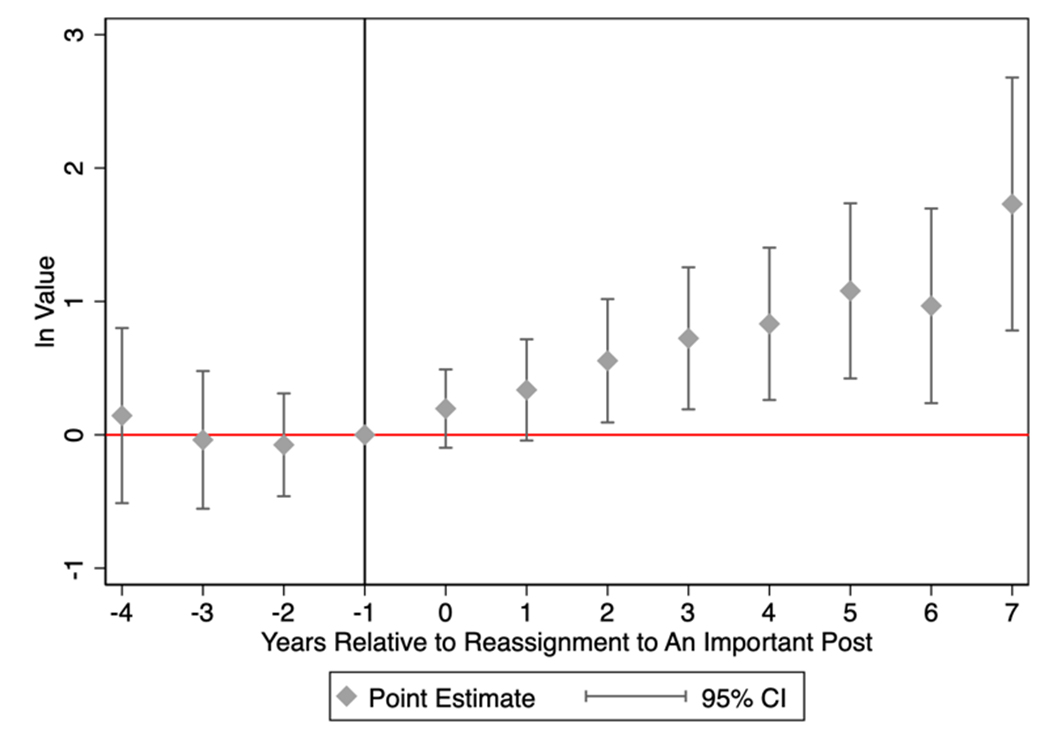

Figure 2 shows that the value of the immovable properties increases by 21% during the year of the transfer compared to the previous year. The effect is incremental, and six years after the reassignment, on average the value of these assets grows by 163%. The steady increase in the coefficients in both figures implies that the impact of reassignment is not temporary and might continue to grow over time. Accordingly, these results correspond to a 10% higher annual growth rate for the value, and a 4.4% increase in the number of immovable properties of an officer, as compared to what they would have otherwise.

Figure 2. Reassignment of officers and change in the value of assets

How reassignment impacts the wealth accumulation of bureaucrats

We explore several mechanisms that may drive the main results, starting with the rent-seeking behaviour of bureaucrats. Officers in important positions may seek or accept bribes, as their jobs might be significantly impacting people's lives and economic activities (Wade 1985, Banik 2001). To test this mechanism, we conduct heterogeneity analyses (comparisons across sub-groups) of the effects at different ministries and different states separately7. At the ministry level, we proxy for corruption by focussing on ministries (such as Finance and Urban Development) that are documented as being the most corruption-prone by Transparency International India8. We find that the increase in immovable properties is mainly driven by reassignment to important ministries that are corruption-prone. We also perform heterogeneity analyses at the state level by examining whether the asset impact of transfers is more prominent in high corruption-prone states (for example, Karnataka, Andhra Pradesh, and Tamil Nadu) based on the findings by the Centre for Media Studies (2017). We find that the effects of bureaucratic transfers on the value of immovable properties in corruption-prone states are more than 3.2 times larger than in other states. In addition, we find that assets increase more for officers working in their home states after reassignment to a corruption-prone ministry, possibly due to greater familiarity with the local environment and language, enabling them to exploit advantages for private gains.

We also exclude other competing mechanisms that may explain the results. For example, we document that the results are less likely driven by the life-cycle decision of buying real estate after reassignment (that is, officers transferred to important ministries might decide to buy especially their first house or flat since they may have better career prospects) by showing that officers with no immovable properties prior to the reassignment are not the ones driving the asset change. We rule out the possibility that the results might be explained by promotions or salary increases after the transfer, and the effects are still robust after controlling for changes in the job titles of officers. We also show that changes in the price of real estate in the new location after reassignment do not explain the main results.

Conclusion

We examine the high-powered incentives in the form of private returns for bureaucrats after bureaucratic reassignment in India's context and find that officers who are transferred to an important ministry see their immovable properties increase, both in value and number. Our findings indicate that the private returns of bureaucratic reassignment are high. We argue that the main effects of reassignment are consistent with an explanation based on the rent-seeking behaviour of officials.

These findings provide new insight into the conventional view that bureaucracies typically provide low-powered incentives. Instead, we provide novel evidence on the high-powered incentives available to bureaucrats in the form of private financial returns. These private returns, partly explained by rent-seeking, may undermine government effectiveness due to the multi-tasking feature of bureaucracies. Our findings also suggest an alternate way to detect the rent-seeking behaviour of bureaucrats by comparing officials' assets before and after bureaucratic transfers.

Notes:

- Based on figures from the IAS Civil List web portal.

- To account for this, in our study, we control for individual fixed effects and several trends to alleviate the concerns on the endogeneity of transfer. Fixed effects control for time-invariant unobserved individual characteristics.

- Binary variables are variables which take two values.

- Panel data documents the same unit of observations repeatedly across time.

- Difference-in-differences is a technique to compare the evolution of outcomes over time in similar groups that gained access to an ‘intervention’ with other groups that did not.

- In the event study estimation, we estimate the coefficient of each period and this is compared with the last period prior to the reassignment.

- We conduct two heterogeneity analysis, one by different types of ministries, and the other by different types of states. We explore heterogenous effects of transferring to corruption-prone ministries and non-corruption-prone ministries. We then we explore the heterogenous effects of transferring to important ministries in corruption-prone and non corruption-prone states separately.

- The classification is based on a large scale study on corruption by Transparency International India (TII) in 2017 (TII, 2017).

Further Reading

- Banik, Dan (2001), "The transfer raj: Indian civil servants on the move", The European Journal of Development Research, 13(1): 106-134.

- Besley, Timothy and Maitreesh Ghatak (2018), "Prosocial motivation and incentives", Annual Review of Economics, 10: 411-438.

- Centre for Media Studies (2017), ‘CMS-India CorruptIon Study 2017: perception and experience with public services and snapshot view for 2005-17’, Report.

- Chaudhary, A and S Yuan (2021), ‘Private Returns to Bureaucratic Appointments: Evidence from Financial Disclosures’, Working paper. Available here.

- Iyer, Lakshmi and Anandi Mani (2012), "Traveling agents: political change and bureaucratic turnover in India", Review of Economics and Statistics, 94(3): 723-739.

- Reserve Bank of India (2017), ‘The Indian Household Finance’, Report of the Household Finance Committee.Transparency International India (2017), ‘India Corruption Survey 2017’, Report.

- Wade, Robert (1985), "The market for public office: Why the Indian state is not better at development", World Development, 13(4): 467-497.

Social media is bold.

Social media is young.

Social media raises questions.

Social media is not satisfied with an answer.

Social media looks at the big picture.

Social media is interested in every detail.

social media is curious.

Social media is free.

Social media is irreplaceable.

But never irrelevant.

Social media is you.

(With input from news agency language)

If you like this story, share it with a friend!

We are a non-profit organization. Help us financially to keep our journalism free from government and corporate pressure

0 Comments