Keelan Beirne

Senior Research Specialist, Princeton University

Martina Kirchberger

Ussher Assistant Professor in Development Economics, Trinity College Dublin

Market power in the construction sector raises prices and undermines long-term growth in poor countries

An increasing body of evidence highlights the importance of key sectors for economic development (Kremer 1993, Jones 2011, Baqaee and Farhi 2020, Liu 2019). One sector that plays an important role is the construction sector, which provides the structures that are used as inputs in the production of most goods. Buildings and infrastructure such as roads, bridges, ports, and airports are vital for almost any economic activity. Across countries, the construction sector accounts on average for about half of investment (gross fixed capital formation), with the remainder consisting of machinery and equipment (about 38%) and other products such as computer software (about 9%). While there is a substantial literature on the cost of machinery and equipment (Eaton and Kortum 2001), little is known about costs in the construction sector.

In our study (Beirne and Kirchberger 2021), we compile data from the International Comparison Project (ICP) on key input prices in the construction sector to look in detail at how these vary across space. We pay particular attention to cement, a key intermediate input in construction. Cement is used abundantly around the world: mainly in concrete, the world’s second most used resource. Cement has few, if any, substitutes, and certain types of infrastructure (for example, dams) cannot be built without it. Cross-country comparisons are possible because cement is a fairly homogenous good, such that differences in quality are relatively small. Cement is largely non-traded: only 5% of global cement consumption is traded. Finally, the cement industry is characterised by significant market power, both in developed as well as in developing countries (McBride 1983, Röller and Steen 2006, Miller and Osborne 2014a, World Bank 2016, Global Competition Review 2020). Our work therefore also builds on a recent literature that highlights the importance of market power at a global level (De Loecker and Eeckhout 2021).

Construction inputs and the market structure of the cement industry

We start by showing price differences of eight key construction sector inputs that were collected as part of the ICP in 2011 and 2017: concrete, cement, aggregate, sand, softwood, bricks, mild steel reinforcement bars, and structural steel beams. This allows us to identify potential bottlenecks in construction sector input supply.

The ICP precisely defines these key inputs, including who buys the product as well as the quantity and quality. For example, for cement the ICP records the price of a ton of Ordinary Portland Cement – the most commonly used type of cement – in bags or bulk delivery. This is crucially important given how construction sector inputs can vary substantially in their attributes.

We then collect and hand-code current and historical data on the market structure of the cement industry, working mostly from industry publications. We document three novel motivating facts at a global level:

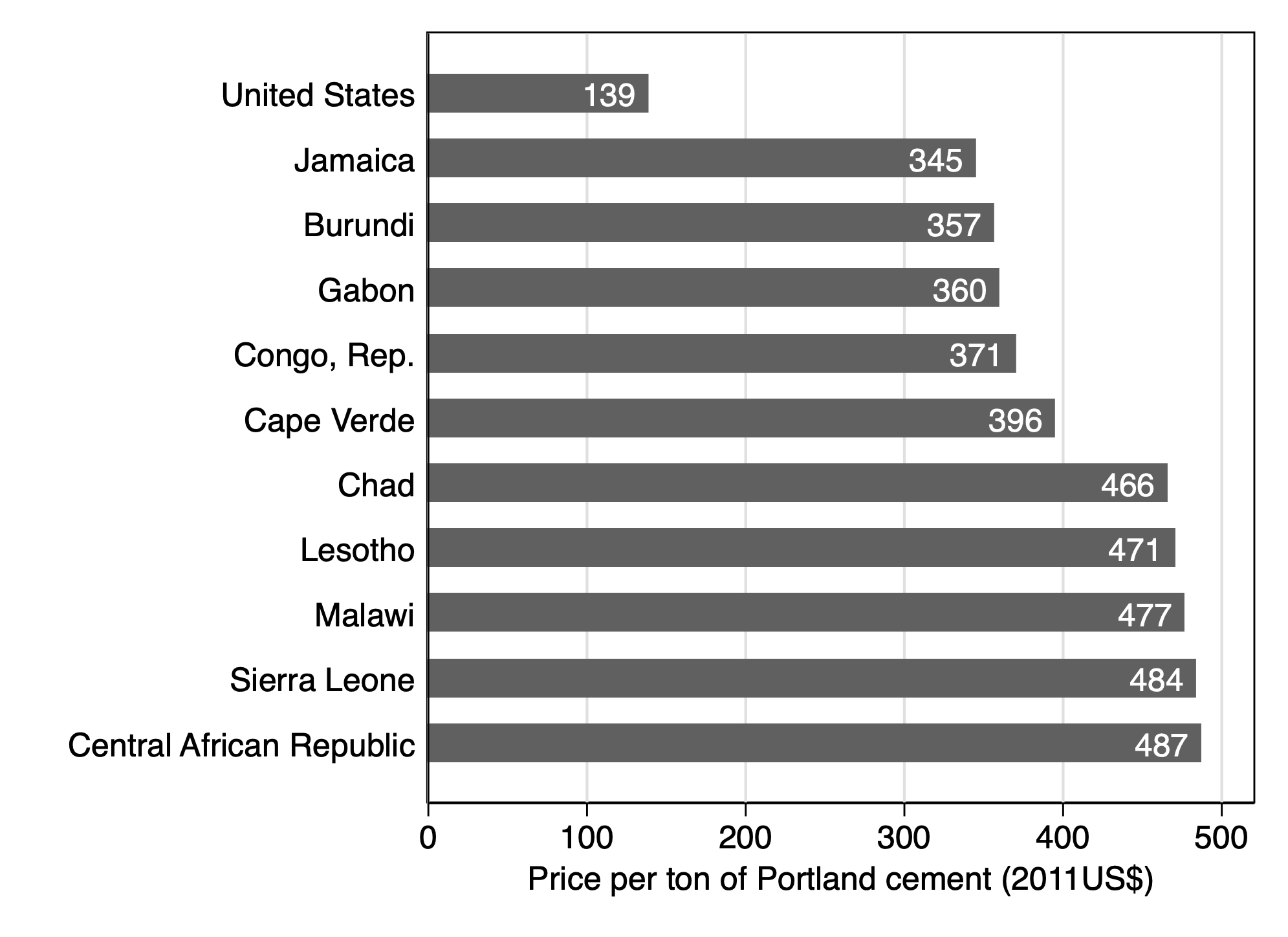

- Price dispersion of precisely defined key construction-sector intermediate inputs is large. Sub-Saharan Africa faced the highest cement prices in 2011. This is in line with a report by the World Bank (2016) that evaluated cement price data from a range of sources for one time period (around 2014) and found that prices were significantly higher in Africa. Figure 1 below shows the price of cement in the ten most expensive countries, nine of which are in Africa.1

Figure 1 Price per tonne of cement in the most expensive countries and the US

Note: This figure shows the average cost of a ton of Portland cement in the ten most expensive countries compared to the United States in 2011.

By 2017 prices had come down considerably in most regions except for Latin America and the Caribbean. However, price gaps of about 32% persist between cement prices in Sub-Saharan Africa and the US.2

- There is significant market power in the cement industry: prices are significantly higher in economies that have a smaller number of firms and where markets are more concentrated, as measured by the Herfindahl-Hirschman index.

- Cement accounts for a sizeable fraction of construction sector expenditures, particularly for the poorest countries. Even for middle-income countries, cement expenditures are on average about 13% of total construction expenditures in 2011 and 2017. In some countries the share rises substantially, for example, to 26% in Nigeria and 45% in Chad.

These facts together imply that the poorest countries with the lowest levels of infrastructure pay the highest price for a key construction sector input. While cement prices largely do not matter in high-income countries, they can have economy-wide ramifications in low-income countries.

Why are cement prices so high in some countries

We examine a number of potential explanations. We start by investigating the role of market structure by writing down and estimating a simple model of oligopoly for the global cement industry. In the model, firms engage in Cournot competition (wherein the firms decide the amount of output to produce independently and simultaneously) with free entry of firms subject to the payment of an entry cost, similar to Melitz (2003) with a finite number of firms. Using a number of different estimation techniques and extensive controls for costs of inputs, scale, and political economy factors, as well as a battery of robustness checks, we find a robust positive relationship between prices and market power.

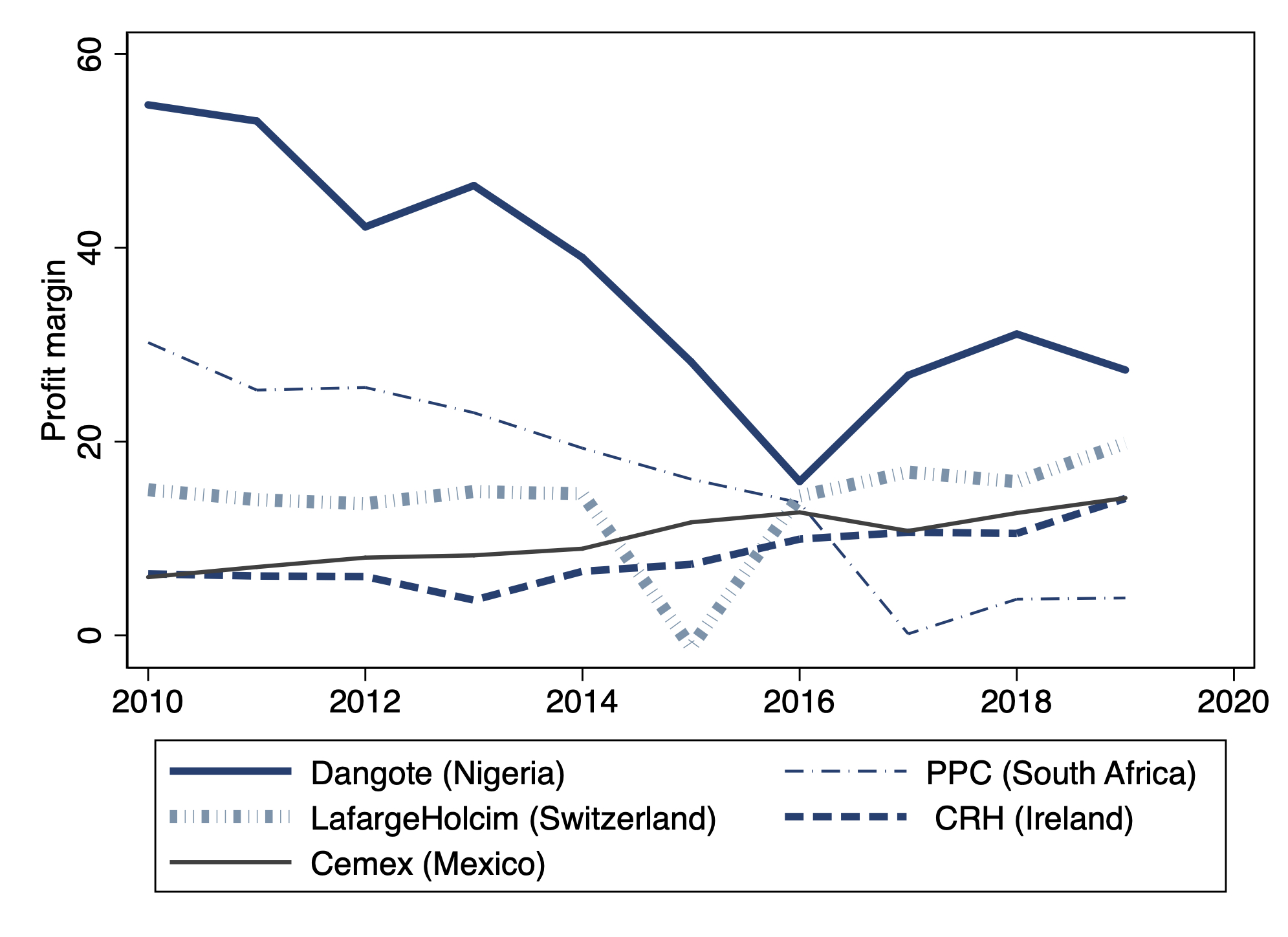

We then investigate two alternative explanations. First, we consider the possibility that prices are high because in smaller markets firms cannot produce at a large enough scale to be efficient. We do not find evidence for this hypothesis: cement plant sizes are similar across geographies, likely because cement is heavy and difficult to transport, which naturally limits how large plants can become. A second alternative explanation for the high prices is that firms might need to charge high markups due to high fixed costs of operation. To test this hypothesis, we turn to financial accounts data for all publicly listed firms in the cement industry. We measure pure profits in excess of capital returns and fixed costs following Gutiérrez and Philippon (2016). Our results as shown in Figure 2 below suggest that firms have made profits far in excess of reasonable costs, particularly in the early 2010s.3

Figure 2 Annual profit margins for major cement firms, 2010-2019

Note: This figure shows profits over time for selected firms.

What do high input prices in the construction sector mean for capital accumulation?

The final part of our analysis incorporates the oligopoly model into a neoclassical growth model that distinguishes between investment and consumption, an idea going back to Uzawa (1963). This distinction is important as the investment sector produces capital which is an input into next period’s production rather than being a final consumption good. The model illustrates that markups in the investment sector behave like a simple tax on capital. This “tax” reallocates resources from investment to consumption. Although consumption may initially increase, lower investment implies future consumption will fall.

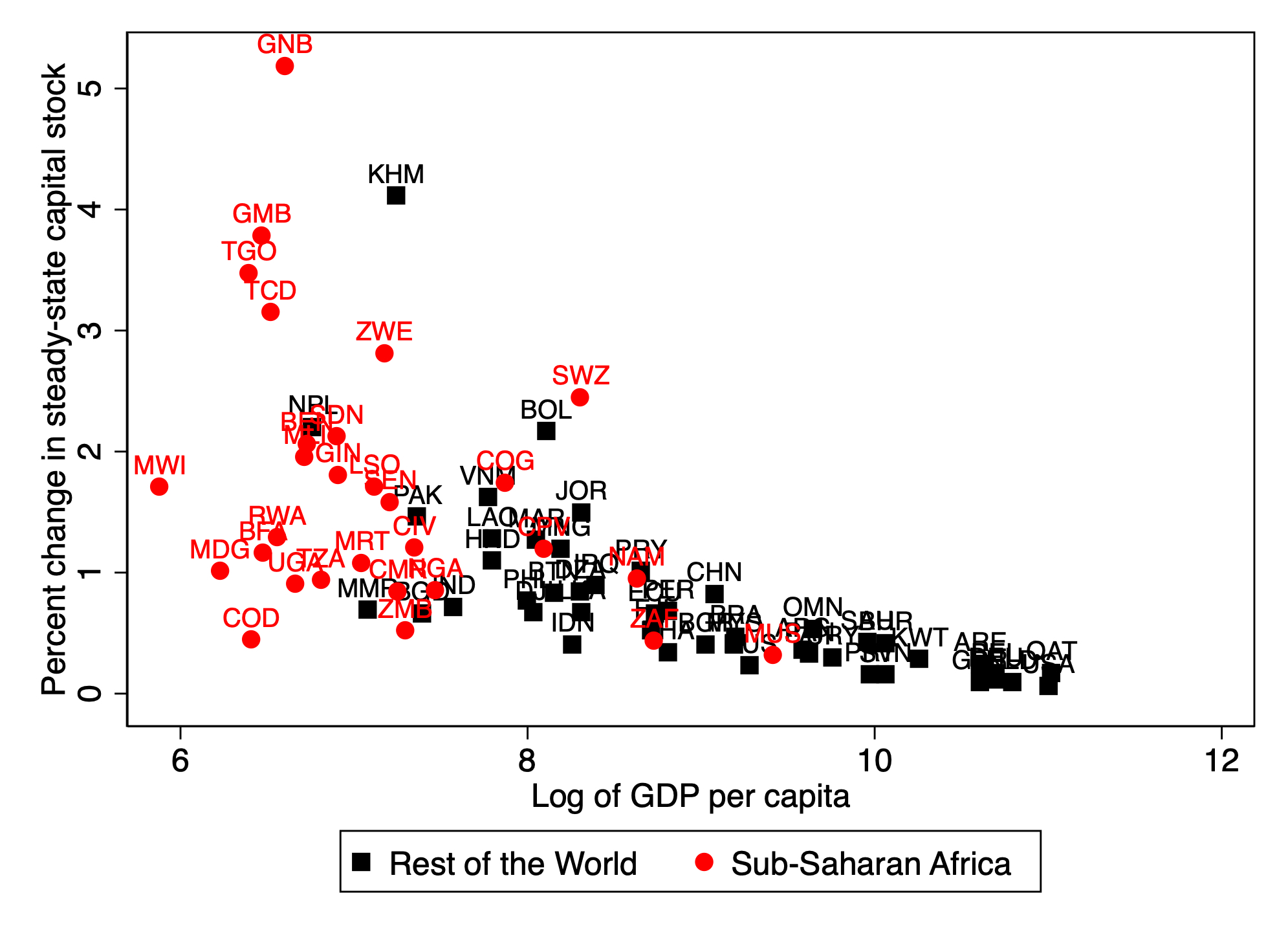

To understand the impact of distortions through markups, we conduct two counterfactual exercises: an increase in the number of firms and a 10% decrease in markups (the latter shown in Figure 3 below).

Figure 3 Long-run effects of a 10% markup decrease

Note: This figure shows the long-run effect on the steady-state value of capital stock of a 10% markup decrease.

Our results illustrate that the capital stock is most sensitive in the poorest countries. The reason is simple: markups are highest in these countries, while cement expenditure is also much higher as a share of total investment.

Conclusions and policy implications

Our work highlights a number of novel facts about construction-sector intermediate input prices, focusing on cement as a key input. We show that market structure plays an important role in explaining high prices, while there is limited evidence that minimum efficient scale and high fixed costs can. Our general equilibrium model then shows that the long-run capital stock is disproportionately sensitive to bottlenecks in essential sectors such as cement.

The study has two main takeaway messages for policymakers: first, our analysis highlights that certain cement firms use their market power to generate excessive profits. Second, these profits are an impediment to overall investment and growth in the broader economy. As countries scale up investment, policymakers may want to pay particular attention to distortions in key sectors that are involved in the production of capital and the role that competition policy can play in removing these distortions.

References

Baqaee, D R and E Farhi (2020), “Productivity and misallocation in general equilibrium,” The Quarterly Journal of Economics 135: 105–163.

Beirne, K and M Kirchberger (2021), “Concrete Thinking About Development,” Trinity Economics Papers tep0621, Trinity College Dublin, Economics Department.

De Loecker, J and J Eeckhout (2021), “Global Market Power,” unpublished manuscript.

De Loecker, J, J Eeckhout and G Unger (2020), “The Rise of Market Power and the Macroeconomic Implications,” The Quarterly Journal of Economics 135: 561–644.

Kremer, M (1993), “The O-ring Theory of Economic Development,” The Quarterly Journal of Economics 108: 551–575.

Jones, C I (2011), “Intermediate Goods and Weak Links in the Theory of Economic Development,” American Economic Journal: Macroeconomics 3: 1–28.

Leone, F, R Macchiavello and T Reed (2021), “ The Falling Price of Cement in Africa” Policy Research Working Paper No 9706.

Liu, E (2019), “Industrial policies in production networks,” The Quarterly Journal of Economics 134(4): 1883-1948.

Gutiérrez, G and T Philippon (2016), “Investment-less Growth: An Empirical Investigation,” Technical report, National Bureau of Economic Research.

Melitz, M J (2003), “The Impact of Trade on Intra-industry Reallocations and Aggregate Industry Productivity,” Econometrica 71: 1695–1725.

Uzawa, H (1963), “On a Two-sector Model of Economic Growth II,” The Review of Economic Studies 30: 105–118.

World Bank (2016), “Breaking Down Barriers: Unlocking Africa’s Potential through Vigorous Competition Policy,” World Bank, Washington, DC.

Endnotes

1 These results use market exchange rates, but the differences are even starker when we use Purchasing Power Parities to convert prices into comparable units.

2 Leone et al. (2021) also use data from the ICP and on the global cement industry and extend our work by estimating a model in the style of Bresnahan (1989) to look in detail at the drivers of markups and decreases in sub-Saharan African prices between 2011 and 2017.

3 We find that markups are even larger when we use a production function estimation approach as suggested by De Loecker et al. (2020).

SOURCE ; voxdev.org/

Social media is bold.

Social media is young.

Social media raises questions.

Social media is not satisfied with an answer.

Social media looks at the big picture.

Social media is interested in every detail.

social media is curious.

Social media is free.

Social media is irreplaceable.

But never irrelevant.

Social media is you.

(With input from news agency language)

If you like this story, share it with a friend!

We are a non-profit organization. Help us financially to keep our journalism free from government and corporate pressure.

0 Comments