Over the past decade, India’s banking sector has undergone a transformation in terms of the proportion of credit extended to consumers and industry – with consumer credit now accounting for a larger share. In this post, Sengupta and Vardhan examine this change and contend that the next couple of years would be crucial in determining whether the ‘consumerisation’ of banking is a cyclical or structural phenomenon.

In the 2010-2020 decade, Indian banking underwent a silent but significant transformation. From providing credit predominantly to industry and businesses, the sector became a provider of credit mainly to consumers. It is unclear if this is just a cyclical phenomenon – which will revert in the next few years – or a more permanent structural change. In this post, we explore the nature, drivers, and possible implications of this transformation.

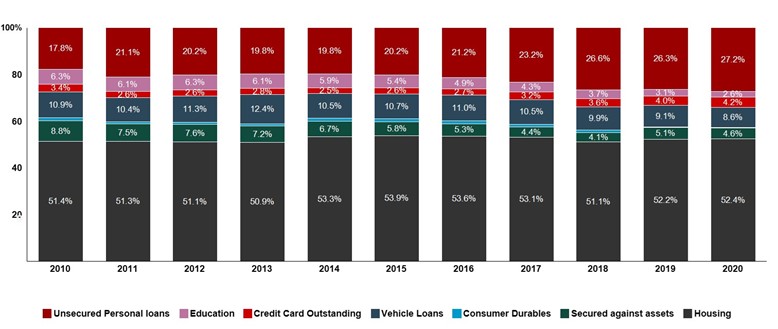

Figure 1 below depicts the share of five main segments of customers of Indian banking: agriculture and allied activities, industry, non-banking finance companies (NBFCs including housing finance companies (HFCs)), services (excluding NBFCs), and consumer loans – for the period of 2010 to 2021.

Figure 1. Segment-wise share of bank credit, 2010 -2021

Banks lend to consumers and businesses (both industry and services) directly, and indirectly through NBFCs. The share of industry in total banking credit was 43% in 2010 and declined to 30% by 2020, while that of consumer loans was 19% in 2010 and it rose to 29% in 2020. It is hard to precisely estimate the shares of NBFC credit that went to businesses and consumers but our sense (based on analysts’ reports) is that as of 2020, around 60% of the credit of NBFCs was extended to businesses and 40% to consumers.

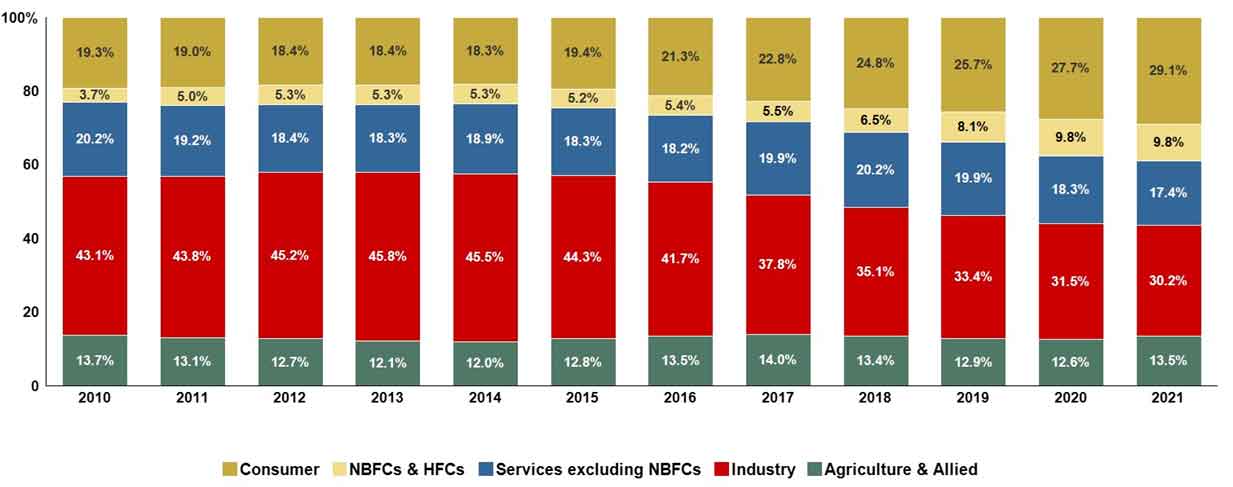

This transformation looks even more dramatic when we consider the shares of these segments in the incremental credit of the banking system – that is, shares in annual ‘flow’ rather than the total ‘stock’ of credit – for the same period. Figure 2 shows an almost exact reversal of the shares of industry and consumer loans in incremental bank credit between 2010 and 2020.

Figure 2. Segment-wise share of incremental banking credit, 2010-2020

When we look at the rate of growth of credit across these segments, it is clear that the rise of consumer loans did not occur uniformly over the decade. In the first half of the decade, segment-wise shares of bank credit remained more or less constant. Table 1 provides the break-up of credit growth in each of these segments in the first half and the second half of the decade.

Table 1. Compounded annual growth rate (CAGR) of banking credit across segments

|

Compounded annual growth rate (CAGR) of credit |

|||

|

|

2010-2015 |

2015-2020 |

2010-2020 |

|

Agriculture and allied activities |

13% |

8.6% |

10.8% |

|

NBFCs |

22.4% |

23.7% |

23.1% |

|

Services excluding NBFCs |

12.4% |

8.9% |

10.7% |

|

Industry |

15.2% |

1.8% |

8.3% |

|

Consumer |

14.8% |

17.0% |

15.9% |

|

Total banking credit |

14.6% |

8.9% |

11.7% |

Table 1 indicates that the year 2015 was an inflexion point. The segment-wise growth rates of credit in the five years before and after 2015 show a stark difference (except for NBFCs). The overall banking credit growth slowed down from 14.6% in the first half of the decade to 8.9% in the second. Growth of consumer loans picked up in the second half, while credit to NBFCs maintained a fairly uniform growth rate throughout the decade. While credit to agriculture and services (excluding NBFCs) decelerated, credit to industry fell from 15.2% in the first half of the decade, to just below 2% in the second. Thus, the equalisation of the shares of industry and consumer loans in banking credit is explained almost entirely by fall in the growth rate of industry loans, and not as much by the growth in consumer loans.

Evolution of consumer credit in India

The consumer lending business is relatively new in India. Prior to the year 2000, government-owned (public sector undertaking or PSU) banks dominated Indian banking, and hardly engaged in any consumer lending. There were a few foreign banks that carried out consumer lending, serving a tiny fraction of high-income metropolitan customers. There were also a handful of HFCs that provided home loans, and some NBFCs that extended credit for buying motor vehicles (cars, two-wheelers, etc.) and trucks. Unsecured lending through credit cards and personal loans existed but were not significant.

New, privately owned banks were licensed in the mid-1990s and started aggressively pursuing consumer lending roughly from 2000 onwards. Till date these banks remain the main drivers of growth in consumer lending and have expanded their geographic coverage considerably over the past 20 years. They facilitated deeper penetration of consumer lending by offering a wider product range and extending credit progressively to the lower income segments. PSU banks followed suit and started lending to consumers by the mid-2000s. By 2010, all large banks had a presence in consumer lending, but new private banks had a dominant position in this space.

As consumer lending grew rapidly during 2010-2020, its composition also changed. Broadly, all consumer lending can be divided into three types: (i) ‘Secured’ lending is the lending that is secured by collateral with high realisable value, such as home loans or loans against the security of bullion, liquid securities, and bank deposits, (ii) ‘Quasi-secured’ lending is collateralised but with assets that have relatively low realisable value, such as loans for vehicles or consumer durables, (iii) ‘Unsecured’ lending that has no collateral and includes mainly credit cards and personal loans.

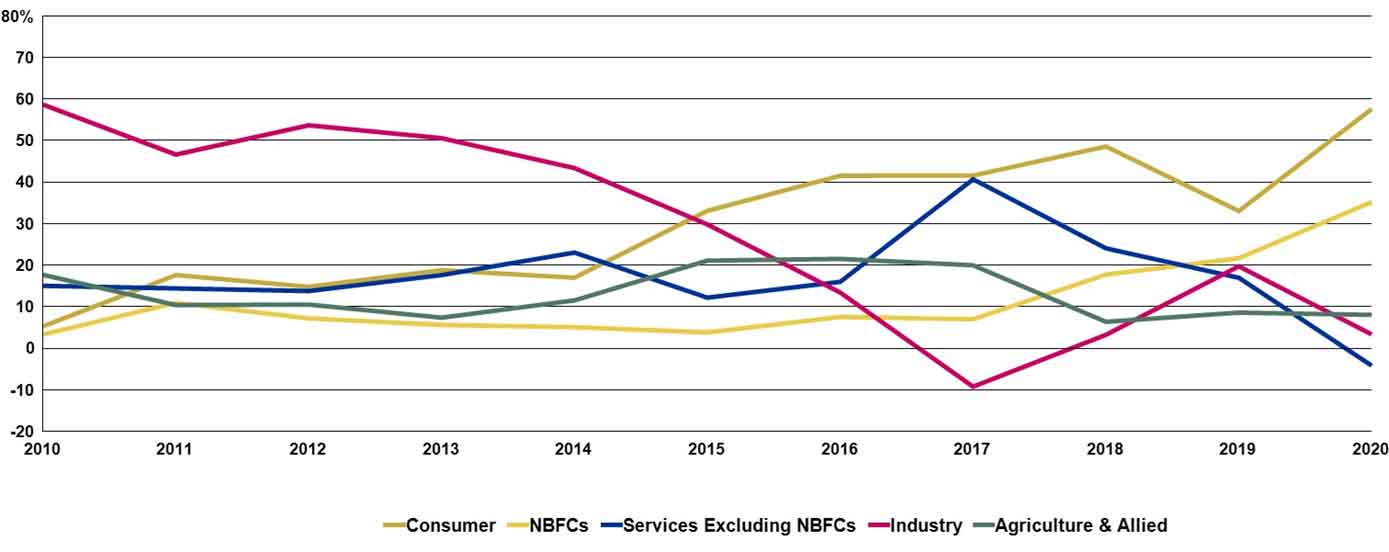

Figure 3 below shows the composition of consumer lending for the period 2010 to 2020.

Figure 3. Break up of consumer credit from banks, 2010-2020

Note: Total unsecured lending includes unsecured personal loans, education, and credit card outstanding. Secured lending includes housing and loans secured against assets. ‘Quasi-secured’ lending includes vehicle loans and consumer durables.

Figure 3 shows a rise in unsecured lending over time. Total unsecured lending was around 28% of total consumer credit in 2010 and this share increased to 34% by 2020. The share of secured lending went down from 60% to 57% while, that for ‘quasi-secured’ lending declined from 12% to 9%. Here again, we see a degree of stability in the break-up of consumer credit from 2010 to 2015, and a sharp rise in unsecured lending thereafter.

Factors driving consumer credit

What explains this rapid growth of consumer credit and the rise in its share in overall bank credit? There are both demand- and supply-side factors that might help to explain this trend. On the demand side, the main factors are economic and demographic.

India’s per capita income crossed US$ 1,000 in 2007, US$ 1,500 in 2014, and US$ 2,000 in 2018. Across economies, these per capita income thresholds have proven to be key inflexion points in the growth of consumer credit. India appears to have followed this global trend.

Aiding the economic driver for consumer credit was a key demographic change. Surveys conducted by financial entities show that Indians start using financial services, including credit, in their thirties. Those born after 1981, referred to as the ‘millennials’, are especially open to borrowing for consumption. These millennials entered their30s from 2011 and started actively using financial services. Several other financial service businesses such as asset management (mutual funds), insurance, payment products, and so on, have grown rapidly on the back of these consumers.

On the supply side of credit as well, there have been some important changes. Following a regulatory change in the early 2010s, all consumer lenders were required to share their customer data with accredited credit bureaus. This vastly improved the coverage of credit bureaus and made it easier for newer players to enter the consumer-lending business without having an information disadvantage over the more established ones. As a result, more banks and NBFCs entered the consumer-lending business and expanded the customer segments they were serving.

Another important trend that paralleled the rise of consumer credit was an increase in the market share of new private players in banking. The rising share of private banks led to lower market shares for PSU banks. By 2010, the share of private banks had stabilised at around 20% of the banking business – both in deposits and in credit. As PSU banks went into a non-performing loans (NPL) crisis in the early-2010s, they started losing market share rapidly to private banks.

Again, 2015 proved to be an inflexion point. In 2015, the market share of private banks in banking deposits and credit was 20% and 21%, respectively, and by 2020, their share had risen to 29% in deposits and 34% in credit1. Over 80% of the incremental growth in the banking business between 2015 and 2020 was contributed by private banks. These banks have historically had a much higher share of consumer credit business compared to the PSU banks. The three largest private banks extend over 50% of their credit to consumers compared to PSU banks that have less than 20%. Thus, as private banks rose in the overall share of banking business, it further fuelled the growth in the share of consumer credit.

Finally, arguably technology played a critical role in the growth of consumer credit. Use of technology in acquiring, on-boarding, and servicing customers has increased dramatically. It has reduced the cost of servicing a large number of customers, especially those in remote locations. Leveraging analytical tools led to better customer targetting, credit assessment, and cross-selling of credit products. The rise of e-commerce contributed to the wider use of credit cards, and also access to credit for e-commerce transactions through ‘buy now pay later’ programmes that these e-retailers offered in partnership with lenders.

Implications of the rise of consumer credit

The rise of consumer credit in India is too recent and short-lived to conclusively determine if it is a permanent shift or merely a cyclical phenomenon. While consumer credit has shown robust growth of over 15% through the decade, its gain in the share of total banking credit has been accompanied almost perfectly by a precipitous fall in credit to industry. Private sector investments have consistently fallen during this period, and the decline in credit to industry is quite likely an outcome of this fall. Other factors such as heightened risk aversion among bankers (especially PSU bankers) after the NPL crisis, and the introduction of the new bankruptcy law in 2016 that significantly strengthened creditors’ rights in the event of bankruptcy, could have also contributed to the fall in credit to industry. While in the long run, stronger creditor rights can boost lending, in the short term it can impact corporate borrowers’ appetite for credit.

Given its state of development, India will consistently need large investments in the economy in order to sustain its aspirational growth rate of over 7% in real GDP (gross domestic product). Furthermore, most of these investments must come from the private sector, as the private sector is the main engine of investment and growth. The banking sector still mobilises over two-thirds of the household savings and is the largest platform to provide credit to the private sector. In the event of a cyclical upturn in private sector investments in the coming years, industry will need to regain its share of banking credit.

Bond markets are skewed towards highly rated borrowers, and hence it is unlikely that they will emerge as a strong substitute for banks. Consumer credit represents credit to the ‘demand’ side of the economy while industrial credit represents credit to the ‘supply’ side. Imbalance between demand- and supply-side credit cannot persist for long, if economic growth is to be sustained.

On the other hand, the economic and demographic factors driving consumer credit growth would suggest that this growth is likely to be sustained for a long time. The median age of Indian population is around 27 years, which means that over 50% of the population is below 30 years and yet to become active consumers of financial services. Continued increase in per capita income could further encourage consumer borrowing.

One noteworthy facet of Indian consumer credit is that there has not been a widespread credit bust since it started in 2000. Most economies with a longer history of consumer credit have experienced cycles where every few years there is a downturn, resulting in rising consumer defaults and slowdown or even decline in consumer credit. India has not yet witnessed such a situation except a two-year bad patch for credit card loans between 2008 and 2010. It is also important to note that India does not have a well-drafted, modern law to deal with personal bankruptcies. The current legal framework for personal bankruptcy is a patchwork of British-era laws. Hence, if there were to be a consumer credit bust, there is no robust legal framework to deal with it.

The Covid-19 pandemic – a virulent second wave of which began in April 2021 – has raised serious concerns about the impact on consumer credit. Given the widespread loss of jobs and incomes and consequently damaged household balance sheets, there is a strong likelihood that we would see a rise in defaults on consumer loans. A recent research report from State Bank of India notes a sharp increase in household debt in India – from around 32% of GDP at the end of FY2019-20 (financial year) to over 37% of GDP at the end of FY2020-21. Even the RBI has expressed concern over the ‘stress’ building up in consumer credit. The extent of this impact may not be visible for a while, as the banking regulator has permitted restructuring of loans. However, it is imperative to understand how this problem can be resolved, as and when it resurfaces. The banking sector, particularly PSU banks have already been reeling under severe strain owing to NPLs from industrial credit. One more major shock in the form of consumer loan defaults will further weaken the banking sector – this time the private banks more than the PSU banks.

Banking in India appears to be at a crucial juncture. The next couple of years will decide if it goes back to being a lender to industry and businesses, or if it will continue to focus on consumer lending. If the ‘consumerisation’ of banking continues, it will have a profound impact on the economy in general and on the growth of industry in particular. For sustained economic growth, capital expenditure cycles will have to be revived. Indian companies will have to get back to investments and will need credit to do so. The preference of bankers to lend to consumers over industry, could create a credit shortfall, which may impede the investment cycle and ultimately harm economic growth.

The authors would like to thank Josh Felman for helpful comments.

0 Comments